Rising Demand in Pharmaceuticals

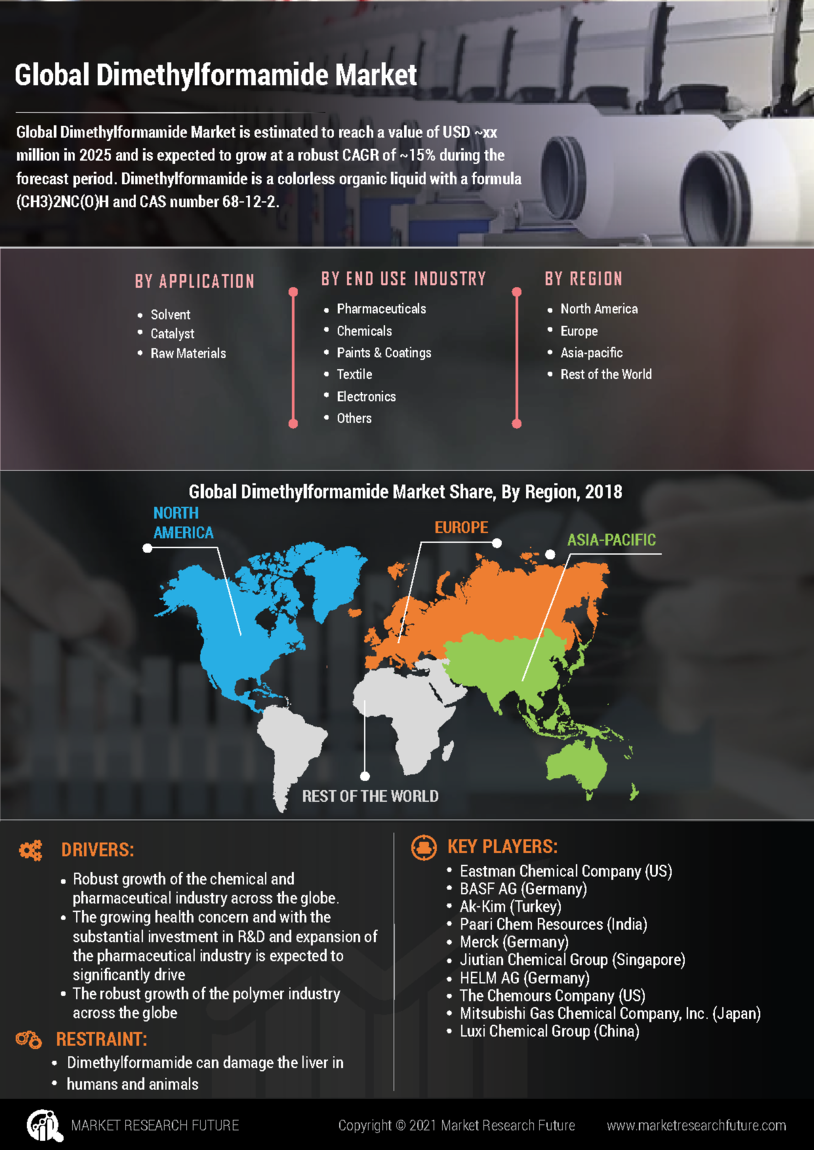

The Dimethylformamide Market is experiencing a notable increase in demand from the pharmaceutical sector. This chemical is utilized as a solvent in the synthesis of various active pharmaceutical ingredients (APIs). As the pharmaceutical industry continues to expand, driven by an aging population and increasing healthcare needs, the demand for high-quality solvents like dimethylformamide is likely to rise. In 2025, the pharmaceutical sector is projected to account for a significant share of the overall dimethylformamide consumption, indicating a robust growth trajectory. Furthermore, the increasing focus on drug development and innovation suggests that the reliance on dimethylformamide will persist, thereby bolstering its market position.

Expansion of Electronics Industry

The Dimethylformamide Market is significantly influenced by the expansion of the electronics sector. Dimethylformamide Market is utilized in the production of semiconductors and electronic components, where it serves as a solvent for various chemical processes. With the increasing demand for electronic devices, including smartphones and computers, the electronics industry is projected to grow at a CAGR of around 6% through 2025. This growth is likely to enhance the consumption of dimethylformamide, as manufacturers seek efficient solvents for their production processes. Consequently, the electronics sector's expansion is expected to be a key driver for the dimethylformamide market.

Growth in Agrochemical Applications

The Dimethylformamide Market is also witnessing growth due to its applications in agrochemicals. This solvent is essential in the formulation of pesticides and herbicides, which are critical for enhancing agricultural productivity. As the global population continues to grow, the demand for food security drives the agrochemical market, subsequently increasing the need for dimethylformamide. In recent years, the agrochemical sector has shown a compound annual growth rate (CAGR) of approximately 5%, which is expected to continue into 2025. This trend indicates that dimethylformamide will play a vital role in supporting agricultural advancements, thus contributing to the overall market growth.

Increasing Use in Polymer Production

The Dimethylformamide Market is experiencing growth due to its increasing use in polymer production. Dimethylformamide Market is a key solvent in the manufacturing of various polymers, including polyacrylamide and polyurethane. As industries seek to develop advanced materials with superior properties, the demand for dimethylformamide in polymer applications is likely to rise. The polymer market is projected to grow at a CAGR of approximately 4% through 2025, indicating a strong potential for dimethylformamide consumption. This trend suggests that the chemical will continue to play a crucial role in the development of innovative polymer solutions.

Innovations in Chemical Manufacturing

The Dimethylformamide Market is benefiting from innovations in chemical manufacturing processes. Advances in production techniques, such as more efficient synthesis methods and improved purification processes, are likely to enhance the quality and reduce the costs associated with dimethylformamide production. These innovations may lead to increased availability and affordability of dimethylformamide, making it more attractive to various industries. As manufacturers adopt these new technologies, the overall market for dimethylformamide is expected to expand, driven by enhanced production capabilities and a broader application range.