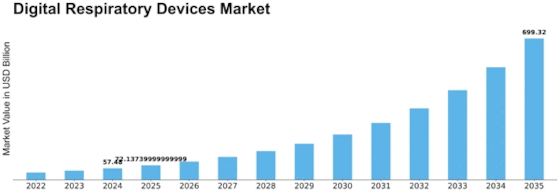

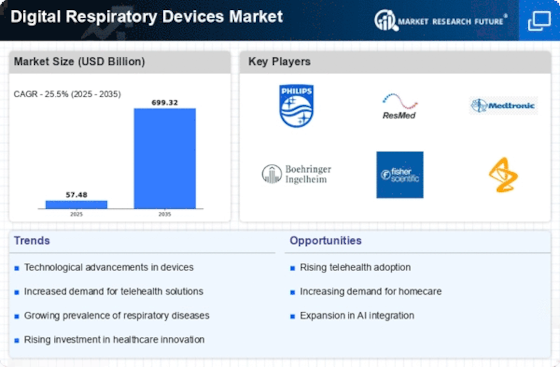

Digital Respiratory Devices Size

Digital Respiratory Devices Market Growth Projections and Opportunities

Conventional inhalers have long been the stalwart devices for delivering doses to asthma or Chronic Obstructive Pulmonary Disease (COPD) patients. However, a transformative wave is sweeping through respiratory care with the advent of Smart Inhalers. These innovative devices go beyond the traditional inhalers by incorporating sensors into metered dose inhalers, revolutionizing the way patients manage their conditions. Smart Inhalers not only record dosage and frequency but also feature integrated apps that serve as companions in a patient's respiratory journey, offering reminders, usage guidance, and valuable insights into their symptoms.

The fundamental distinction between conventional inhalers and Smart Inhalers lies in their capabilities and the level of engagement they facilitate for patients managing respiratory conditions. Conventional inhalers, while effective in delivering medication, lack the sophisticated features that empower patients to actively participate in their care. On the other hand, Smart Inhalers harness the power of technology to provide a comprehensive and personalized approach to respiratory management.

At the core of Smart Inhalers is the integration of sensors into the traditional metered dose inhalers. These sensors record crucial information such as dosage and the frequency of medication use. This data, once collected, serves as a valuable tool for both patients and healthcare providers. It allows for precise tracking of medication adherence, providing insights into whether patients are following their prescribed treatment plans. This real-time monitoring is a game-changer, enabling healthcare professionals to intervene promptly if deviations or issues arise.

The transformative potential of Smart Inhalers extends beyond basic data recording. The integration of smartphone apps amplifies their impact by creating a seamless and user-friendly experience for patients. These apps offer a range of functionalities designed to enhance patient engagement and facilitate effective self-management of respiratory conditions.

One key feature of Smart Inhaler apps is the ability to send reminders to patients, ensuring that they adhere to their prescribed dosage schedules. This simple yet powerful function addresses one of the significant challenges in respiratory care—medication adherence. Forgetting to take medications as prescribed can lead to exacerbations of symptoms and a decline in overall respiratory health. Smart Inhaler apps act as vigilant companions, sending timely reminders to patients and helping them stay on track with their treatment plans.

Beyond reminders, Smart Inhaler apps provide invaluable assistance in the usage of the device itself. Many patients, especially those newly diagnosed, may struggle with the proper inhalation technique. Smart Inhaler apps often feature instructional guides and visual aids, helping patients master the correct inhalation technique. This guidance contributes to the overall effectiveness of the treatment, ensuring that patients receive the full benefit of their prescribed medications.

Perhaps one of the most significant advantages offered by Smart Inhalers is the empowerment of patients to monitor and understand their symptoms. Unlike conventional inhalers, Smart Inhalers enable patients to log and track their symptoms, creating a comprehensive record over time. This data becomes a valuable resource during medical consultations, allowing patients to provide detailed insights into their respiratory health. It also facilitates a proactive approach to care, as patients can identify patterns or triggers associated with their symptoms, fostering a deeper understanding of their condition.

The personalized insights provided by Smart Inhalers empower patients to become active participants in their healthcare journey. By recognizing patterns in their symptoms and understanding the factors influencing their respiratory health, patients gain a sense of control and autonomy over their conditions. This level of engagement is a paradigm shift from the passive role often associated with traditional inhaler usage.

As the healthcare landscape evolves, the role of technology in respiratory care becomes increasingly pivotal. Smart Inhalers, with their combination of sensor technology and integrated apps, represent a significant leap forward in enhancing patient outcomes and reshaping the approach to managing respiratory conditions. From precise medication tracking to personalized insights and guidance, Smart Inhalers offer a holistic solution that transcends the limitations of conventional inhalers.

In conclusion, the emergence of Smart Inhalers marks a transformative chapter in respiratory care. These innovative devices bridge the gap between traditional inhalers and advanced technology, providing patients with a comprehensive and personalized approach to managing asthma and COPD. With their ability to record dosage, offer reminders, provide usage guidance, and empower patients with insights into their symptoms, Smart Inhalers are poised to redefine the standard of care in respiratory health. As the healthcare industry continues to embrace digital solutions, Smart Inhalers stand as a beacon of innovation, offering a brighter and more empowered future for individuals navigating the complexities of respiratory conditions.

Leave a Comment