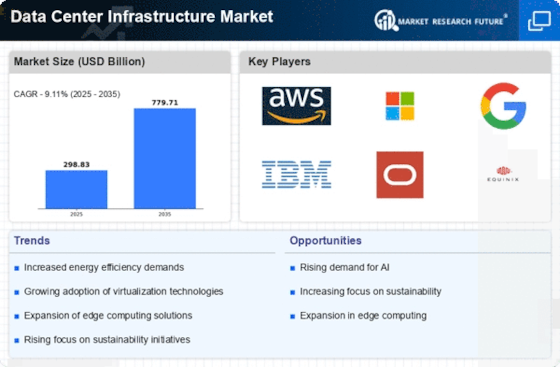

Top Industry Leaders in the Data Center Infrastructure Market

Competitive Landscape of Data Center Infrastructure Market:

The data center infrastructure market, encompassing the hardware, software, and services enabling data storage, processing, and distribution, is experiencing explosive growth fueled by the digital transformation wave. This dynamic landscape is home to established giants, nimble startups, and a continuous churn of innovation, making it crucial to understand the key players, their strategies, and emerging trends.

Key Players:

Strategic Playbook:

- Mergers & Acquisitions: Consolidation is a defining trend, with major players acquiring smaller companies to expand product portfolios, enter new markets, and access cutting-edge technologies. Recent examples include Dell's acquisition of EMC and HPE's merger with Cray.

- Innovation & Specialization: Leading companies are investing heavily in R&D, focusing on areas like artificial intelligence for infrastructure management, energy efficiency solutions, and hyperconverged infrastructure for edge computing. Niche players are carving out spaces by specializing in areas like high-performance computing or green data centers.

- Partnerships & Ecosystem Building: Collaboration is key, with players forming partnerships with technology vendors, service providers, and cloud providers to offer comprehensive solutions and reach new customer segments. Open source software and industry standards are also fostering cross-vendor interoperability.

Factors Driving Market Share Analysis:

- Product Portfolio Breadth & Depth: Companies with a diverse range of hardware, software, and services across the data center stack enjoy a competitive edge.

- Geographical Reach & Market Penetration: Global presence and strong footholds in key regions like North America, Asia Pacific, and Europe are crucial for success.

- Customer Focus & Service Delivery: Adapting to specific customer needs through tailored solutions, flexible financing options, and reliable managed services builds loyalty and market share.

- Technological Innovation & Differentiation: Continuous investment in R&D to develop cutting-edge solutions that address evolving customer challenges attracts new customers and strengthens market standing.

New & Emerging Players:

- Startups in Hyperscale Infrastructure: Fungible, Pensando, and Lightmatter are developing software-defined, disaggregated infrastructure solutions aimed at improving efficiency and scalability in large data centers.

- Edge Computing Specialists: Nutanix, Dell EMC, and Lenovo are focusing on edge computing solutions for distributed data processing at the network edge, a rapidly growing market segment.

- Green Data Center Innovators: Yondr and Schneider Electric are leading the charge in developing next-generation cooling technologies and sustainable data center solutions, addressing growing environmental concerns.

Investment Trends:

- Software Defined Data Center (SDDC): Automation, virtualization, and software-driven management are increasingly sought after, driving investments in SDDC solutions.

- Artificial Intelligence for IT Operations (AIOps): Utilizing AI for predictive maintenance, anomaly detection, and automated optimization is gaining traction, attracting significant investments.

- Edge Computing Infrastructure: The burgeoning edge computing market is attracting venture capital and R&D focus, with solutions tailored for IoT applications and distributed intelligence.

- Cybersecurity for Data Centers: Increased security threats are driving demand for advanced security solutions and services, prompting investments in secure hardware, software, and threat detection/mitigation technologies.

Latest Company Updates:

January 2024, Intel unveils new Xeon CPUs optimized for AI workloads in data centers.

December 2023, Open Compute Project (OCP) announces new specifications for liquid immersion cooling in data centers.

November 2023, Microsoft and NVIDIA collaborate on Project Azure Orbital, bringing AI computing to the cloud edge through small satellites.