Health and Wellness Trends

The Dairy Cream Market is influenced by the growing health and wellness trends among consumers. As individuals become more health-conscious, there is a rising demand for dairy products that align with these values. This includes a preference for creams that are lower in fat, contain probiotics, or are enriched with vitamins. Market Research Future indicates that products marketed as healthier alternatives are gaining traction, with a notable increase in sales of reduced-fat and fortified dairy creams. This shift reflects a broader trend towards healthier eating habits, which is likely to continue shaping the Dairy Cream Market in the coming years.

E-commerce Growth and Online Sales

The Dairy Cream Market is witnessing a transformation due to the rapid growth of e-commerce and online sales channels. Consumers are increasingly turning to online platforms for their grocery needs, including dairy products. This shift is driven by the convenience of home delivery and the ability to access a wider variety of products. Recent data shows that online sales of dairy products have surged, with projections indicating a continued upward trend. As a result, dairy cream manufacturers are investing in digital marketing strategies and partnerships with e-commerce platforms to reach a broader audience. This trend not only enhances accessibility but also contributes to the overall growth of the Dairy Cream Market.

Innovations in Dairy Cream Products

Innovation plays a crucial role in the Dairy Cream Market, as companies strive to differentiate their products in a competitive landscape. The introduction of flavored creams, organic options, and lactose-free variants has expanded the market significantly. Recent statistics suggest that flavored dairy creams have captured a substantial market share, appealing to younger consumers who seek unique culinary experiences. Furthermore, advancements in processing technologies have enabled manufacturers to enhance the shelf life and quality of dairy cream products. This continuous innovation not only attracts new customers but also retains existing ones, thereby fostering growth in the Dairy Cream Market.

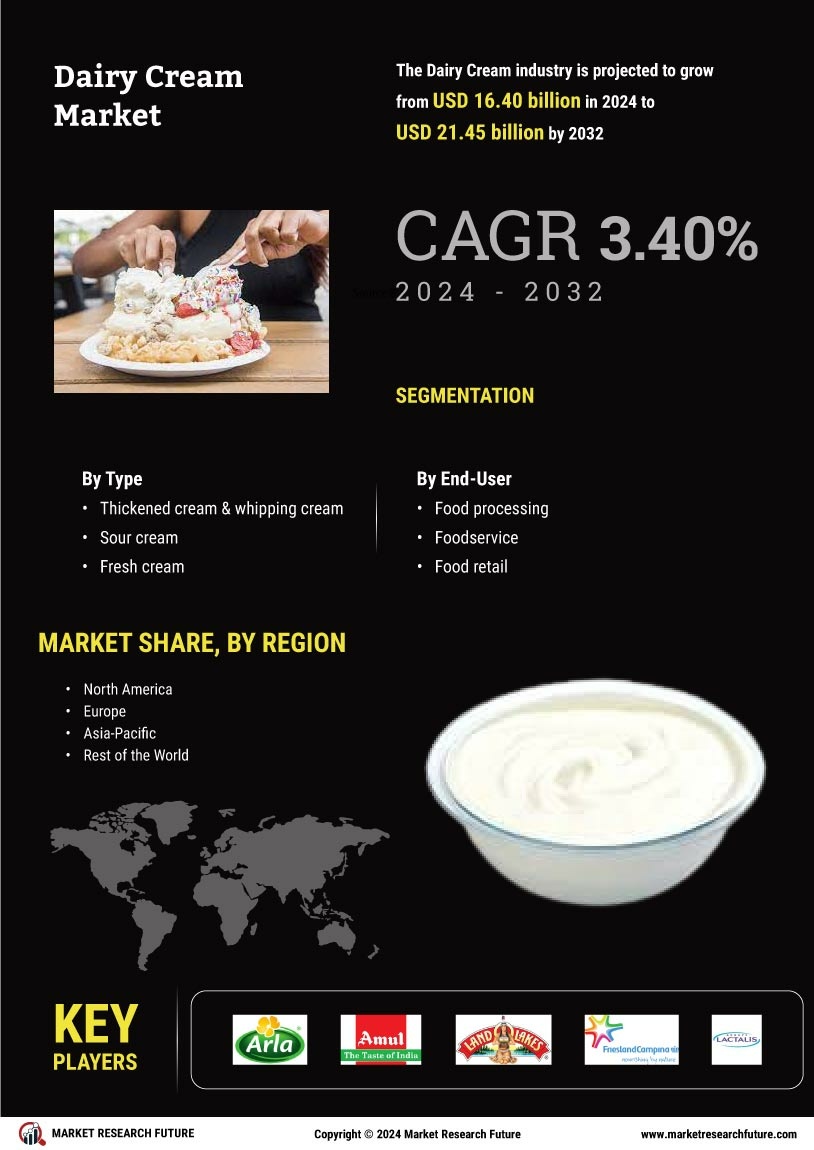

Increased Use in Culinary Applications

The versatility of dairy cream is a driving force in the Dairy Cream Market, as it finds extensive use in various culinary applications. Chefs and home cooks alike utilize dairy cream for its ability to enhance flavors and textures in a wide range of dishes, from sauces to desserts. The rise of cooking shows and food blogs has further popularized the use of dairy cream, leading to increased consumption. Market analysis indicates that the culinary segment accounts for a significant portion of dairy cream sales, with a projected growth rate of 6% over the next few years. This trend underscores the importance of dairy cream in both professional and home kitchens, solidifying its position in the Dairy Cream Market.

Rising Demand for Premium Dairy Products

The Dairy Cream Market is experiencing a notable increase in demand for premium dairy products. Consumers are increasingly seeking high-quality, artisanal options that offer superior taste and texture. This trend is driven by a growing awareness of the benefits associated with premium dairy, including higher nutritional value and better sourcing practices. According to recent data, the premium segment of the dairy market has seen a growth rate of approximately 8% annually, indicating a shift in consumer preferences towards quality over quantity. As a result, manufacturers are focusing on enhancing their product offerings to cater to this discerning consumer base, thereby driving growth within the Dairy Cream Market.