Top Industry Leaders in the Dairy Blends Market

The dairy blends market has witnessed significant growth as a result of changing consumer preferences and the need for innovative and cost-effective dairy solutions. Key players in this sector are strategically positioning themselves to cater to diverse industries, including food and beverage, bakery, and confectionery. This analysis provides insights into the key players, strategies adopted, factors influencing market share, emerging companies, industry trends, overall competitive scenario, and a recent development in 2023.

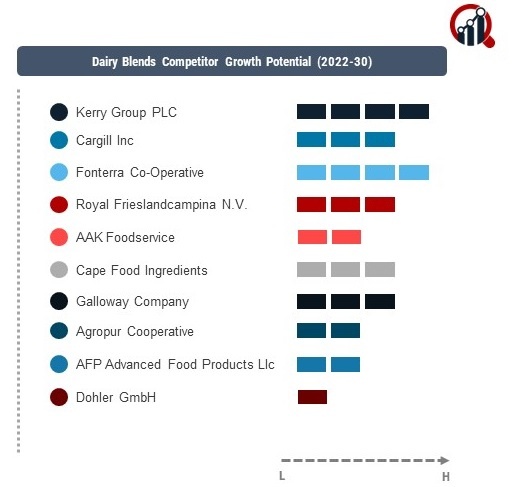

Key Players:

Kerry Group Plc

Cargill Inc.

Fonterra Co-operative

Royal Frieslandcampina N.V.

AAK Foodservice

Cape Food Ingredients

Galloway Company

Agropur Cooperative

Afp Advanced Food Products LLC

Dohler GmbH

Strategies Adopted:

Market Share Analysis:

New & Emerging Companies:

Industry Trends:

Recent industry developments highlight a growing trend towards clean-label and plant-based dairy blends. Major players are investing in research and development to introduce dairy blends with cleaner labels, focusing on natural and recognizable ingredients. Additionally, there is an increased focus on plant-based dairy blends to cater to the rising demand for plant-based alternatives in the food and beverage industry.

In terms of investment trends, companies are exploring technologies to enhance production efficiency. Investments in automation, smart manufacturing, and data analytics contribute to improving the manufacturing processes of dairy blends and ensuring cost-effectiveness.

Competitive Scenario:

The competitive landscape of the dairy blends market is dynamic, with established players adapting to emerging trends and new entrants exploring innovative solutions. The focus on product innovation, strategic collaborations, customization, and addressing consumer trends remains central to the overall competitive scenario.

Recent Development

The dairy blends market was the increased emphasis on sustainability initiatives. Major players introduced comprehensive sustainability programs, including responsible sourcing of raw materials, energy efficiency measures, and waste reduction in the production of dairy blends. This development aligns with the industry's commitment to environmental responsibility and addresses the growing consumer demand for sustainably produced food ingredients. Companies invested in technologies and practices that contribute to reducing the environmental impact of their operations, reflecting a broader industry trend towards sustainable and responsible business practices in the dairy blends market. This shift towards sustainability demonstrates the industry's proactive response to global environmental challenges and the importance of corporate responsibility in the modern business landscape.