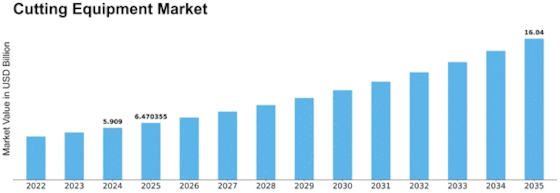

Cutting Equipment Size

Cutting Equipment Market Growth Projections and Opportunities

There are a number of factors that affect the cutting equipment market, and these among other elements determine its dynamics. A critical element is technological development. The introduction of new advanced technologies has given rise to the need for better and more efficient cutting tools. Manufacturers always seek to include novelties such as laser cutting and CNC systems aiming at improving efficiency while keeping up with the ongoing needs in different industries. The global economy also serves a key role in determining the cutting equipment market. In periods of economic boom, industries generally invest more in capacity expansion and modernization which creates an enhanced demand for cutting tools and machinery. On the other hand, recessions could lead to lack of investments and a decline in market activities. Another key driving force of the cutting equipment market is regulatory policies and standards. Manufacturers are prompted to manufacture specific cutting tools due to stringent regulations regarding the safety in workplaces and environment concerns. This has resulted in incorporation of technologies that reduce emissions, noise and other environmental effects as the industry moves towards environment friendly solutions. Precision cutting technologies used in the automotive and aerospace industries largely influence the development of that market, as they are major consumers. The changing demand for vehicles and airplanes, directly impacts the market to make manufacturers adjust their production according to industries. Likewise, the modern building industry is a significant user of cutting tools for its different uses due to urbanization and infrastructure development hence affecting market trends. There is a high level of competition in the market, with many players competing for market share. This battle often breeds continuous innovation along with price competitiveness to distinguish themselves from one another. The market has a combination of major players and new entrants who contribute in their way to the dynamism and growth that is witnessed currently on this platform. The dynamics of the global supply chain also affect cutting equipment market. Product pricing and profitability are directly influenced by the supply of raw materials, especially metal alloys used in cutting tool manufacturing. Moreover, interruptions to the supply chain including those caused by geopolitical issues or natural disasters would cause further effects on the market leading towards shortages and a rise in prices. Customer preference and industry trends are two crucial elements that influence the cutting equipment market. With users seeking efficiency, accuracy and adaptability in their activities, the manufacturers make cutting tools that are geared for these needs.

Leave a Comment