Market Analysis

In-depth Analysis of Cryogenic Capsules Market Industry Landscape

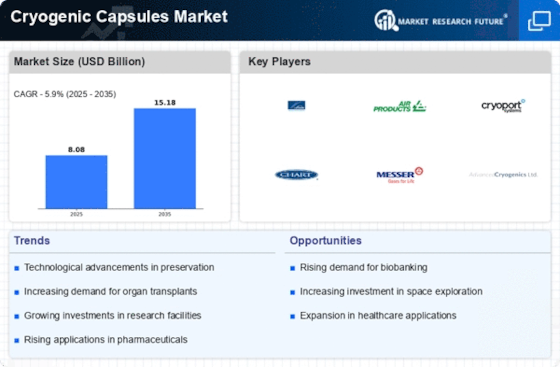

The Cryogenic Capsule Market is witnessing dynamic shifts pushed by means of a confluence of factors that span technological advancements, increasing programs, and evolving up-consumer necessities. Cryogenic capsules, designed to keep and transport substances at extraordinarily low temperatures, have turned out to be crucial components in industries ranging from healthcare and biotechnology to energy and aerospace. One of the important marketplace dynamics is the developing demand for cryogenic capsules within the healthcare area for the garage and transportation of organic samples and prescribed drugs. Advancements in cryogenic generation have played a pivotal function in shaping the market panorama. The improvement of superior insulation substances, coupled with innovative designs, has improved the performance and reliability of Cryogenic Capsules. These upgrades have addressed longstanding demanding situations related to maintaining extremely low temperatures over prolonged intervals, making sure the integrity of touchy materials for the duration of transit and garage. Market dynamics are also formed through the regulatory panorama and safety issues. As industries employing Cryogenic Capsules turn out to be more regulated, adherence to stringent protection standards will become paramount. The competitive panorama of the Cryogenic Capsules marketplace is marked by the presence of key players continuously innovating to take advantage of a competitive side. Strategic collaborations and partnerships are at the upward thrust as agencies are seeking to leverage each other's strengths and competencies to deal with evolving market demands. Additionally, studies and improvement projects are targeted at creating next-technology Cryogenic Capsules with more suitable functions, which include progressed thermal insulation and multiplied capacity. Market dynamics are, in addition, motivated by the geographical distribution of demand. Regions with a sturdy presence in industries including healthcare, electricity, and aerospace are witnessing better demand for Cryogenic Capsules. Emerging economies are getting key gamers inside the marketplace as they spend money on infrastructure development and technological improvements across various sectors. In conclusion, the marketplace dynamics of the Cryogenic Capsules market are characterized by an aggregate of technological improvements, expanding packages, and evolving regulatory landscapes. The interplay of these elements is using the increase of the market, making Cryogenic Capsules imperative in diverse industries. As the demand for dependable and green cryogenic solutions continues to grow, the market is poised for further evolution, with innovation and collaboration at the vanguard of industry strategies.

Leave a Comment