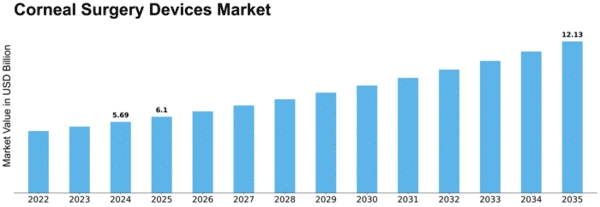

Corneal Surgery Devices Size

Corneal Surgery Devices Market Growth Projections and Opportunities

The increasing worldwide aging population is a key market component using the demand for corneal surgery devices. With age, the superiority of eye problems consisting of cataracts and corneal illnesses rises, necessitating surgical interventions for stepped forward, imaginative, and prescient. Rapid advancements in generation have substantially impacted corneal surgery devices, leading to the improvement of more state-of-the-art and precise instruments. Innovations, together with laser technology and superior imaging systems, beautify surgical results, attracting each surgeon and patient closer to more recent and more efficient devices. The prevalence of eye issues, inclusive of corneal conditions, is on the upward push globally. Factors such as increasing display screen time, pollutants, and way-of-life modifications contribute to the growing occurrence of situations like keratoconus and corneal dystrophies, fueling the demand for corneal surgery devices. Ongoing upgrades in healthcare infrastructure, in particular in rising economies, are creating conducive surroundings for the growth of the corneal surgery devices market. Access to modern healthcare facilities and skilled experts encourages individuals to opt for surgical interventions when wanted. Favorable compensation rules for corneal surgical operation strategies incentivize both healthcare carriers and sufferers. This issue substantially affects the adoption of corneal surgery devices, as it reduces economic boundaries and promotes accessibility to these advanced remedies. Collaborations and partnerships among key market gamers, studies establishments, and healthcare corporations contribute to the overall development and distribution of corneal surgery devices. Shared understanding and assets accelerate innovation and market penetration. Stringent regulatory frameworks ensure the safety and efficacy of corneal surgery devices. Obtaining important approvals from regulatory bodies boosts patron confidence and allows a market boom by ensuring that the gadgets meet the required best requirements. Economic balance and increasing disposable income in positive areas influence the willingness of individuals to invest in superior scientific remedies, along with corneal surgeries. Economic growth contributes to the growth of the general healthcare area, positively impacting the corneal surgery devices market. Intense competition among market gamers fosters continuous studies and improvement in sports. This competitive landscape outcomes from the advent of newer and more efficient corneal surgery devices, providing a wider array of options for healthcare experts and patients.

Leave a Comment