Rising Demand for Smart Devices

The increasing consumer preference for smart devices is a primary driver of the Consumer Electronics Sensor Market. As households become more interconnected, the need for sensors that facilitate communication and automation in devices such as smart thermostats, security systems, and home appliances has surged. According to recent estimates, the market for smart home devices is projected to reach approximately 174 billion USD by 2025, indicating a robust growth trajectory. This trend is likely to propel the demand for various sensors, including motion, temperature, and humidity sensors, which are integral to the functionality of these devices. Consequently, manufacturers are investing in innovative sensor technologies to enhance user experience and meet the evolving demands of consumers.

Expansion of the Internet of Things (IoT)

The expansion of the Internet of Things (IoT) is a significant driver of the Consumer Electronics Sensor Market. As more devices become interconnected, the reliance on sensors to collect and transmit data has increased. IoT applications in consumer electronics, such as smart appliances and wearable devices, require a variety of sensors to function effectively. The number of connected devices is projected to reach over 75 billion by 2025, creating a substantial demand for sensors that can facilitate communication and data exchange. This trend is likely to encourage manufacturers to innovate and develop advanced sensors that can seamlessly integrate with IoT ecosystems, thereby enhancing the overall user experience and driving market growth.

Growing Focus on Environmental Sustainability

The increasing emphasis on environmental sustainability is influencing the Consumer Electronics Sensor Market. Consumers are becoming more aware of the environmental impact of their purchases, leading to a demand for eco-friendly products. Sensors that monitor energy consumption, air quality, and other environmental factors are gaining traction as they contribute to sustainable living. For example, energy-efficient sensors that help reduce power consumption in electronic devices are becoming essential in the design of new products. This shift towards sustainability is expected to drive innovation in sensor technology, with manufacturers focusing on developing sensors that not only meet performance standards but also align with eco-friendly practices. As a result, the market is likely to witness a rise in demand for sensors that support green initiatives.

Technological Advancements in Sensor Technology

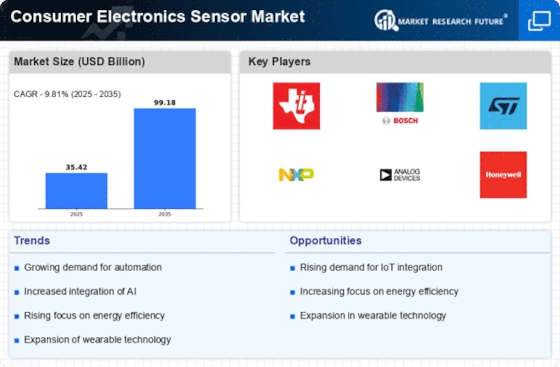

Technological advancements play a crucial role in shaping the Consumer Electronics Sensor Market. Innovations in sensor technology, such as miniaturization, improved accuracy, and enhanced energy efficiency, are driving the development of new applications across various consumer electronics. For instance, the introduction of MEMS (Micro-Electro-Mechanical Systems) sensors has revolutionized the market by enabling the integration of multiple sensing capabilities into compact devices. The market for MEMS sensors alone is expected to grow significantly, with projections indicating a value of around 18 billion USD by 2025. These advancements not only improve the performance of existing devices but also pave the way for the creation of entirely new product categories, thereby expanding the market landscape.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is propelling the Consumer Electronics Sensor Market forward. Companies are allocating significant resources to explore new sensor technologies and applications, aiming to stay competitive in a rapidly evolving market. This focus on R&D is leading to the development of advanced sensors with enhanced capabilities, such as improved sensitivity and faster response times. Furthermore, collaborations between technology firms and research institutions are fostering innovation, resulting in the introduction of cutting-edge sensor solutions. The global investment in R&D for sensor technologies is expected to rise, with estimates suggesting a growth rate of around 7% annually. This trend indicates a commitment to advancing sensor technology, which is likely to benefit the consumer electronics sector as a whole.