Market Share

Construction Mining Equipment Market Share Analysis

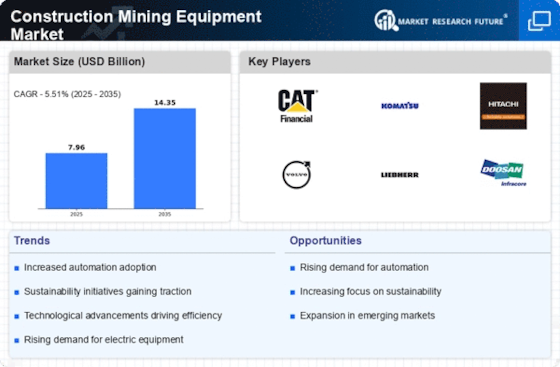

Leading companies put a lot of value on constant product innovation and technological advances. Introducing equipment with more functions, and higher efficiency. Part of a strategic plan is to make construction and mining tools fit the needs of specific industries, like building, mining, and tunneling. Offering specialized solutions makes a business more competitive in the market. Markets are following trends in sustainability by pushing actions that are good for the environment. As an example, companies that make tools for mining and building are putting money into low-emission tools, systems that use less energy, and the use of alternate fuels. These steps help the company gain market share and appeal to customers who care about the environment. Industry growth depends on businesses growing into new global areas in a smart way. Companies that make heavy machinery for building and mining set up shop in places where roads and mines are being built and where heavy machinery is in high demand. Now that the world is smaller, businesses can enter new areas and fight better. In today's business world, digital marketing is key to having a strong online footprint. To show off their goods, meet with new customers, and share teaching material, companies that sell mining and building tools use digital platforms. With digital marketing, the market is easier to see and has more competition. Branding that shows how reliable, well-performing, and unique their goods are costs a lot of money for businesses that make construction and mining tools. When a company takes care of its name well, it builds a good brand picture that helps it make more sales. Putting money into training and development for employees is a smart business move. Companies that sell construction and mining equipment teach their workers how to use the equipment, follow safety rules, and deal with customers. Having a trained staff makes the business more efficient and competitive in the market as a whole. There are benefits to using new technology in manufacturing, including making the process faster and better products. For example, companies that make tools for mining and building spend a lot of money on new ways to make things, like robotics and digital. Companies can become market stars and succeed by using new technologies. Implementing equipment that uses less energy is a complete strategy for positioning in the market. Companies that make construction and mining equipment invest in technologies and designs that lower fuel use and damage to the environment. Energy-efficient practices support sustainability goals and help companies become market leaders. Training and educational programs help with market positioning. Companies that make construction and mining equipment hold workshops, educational campaigns, and training programs to teach operators, contractors, and industry professionals about the features and benefits of their equipment. These strategies help raise market awareness and preference. "The market dynamics are closely linked to the overall level of construction and mining activities worldwide.

Leave a Comment