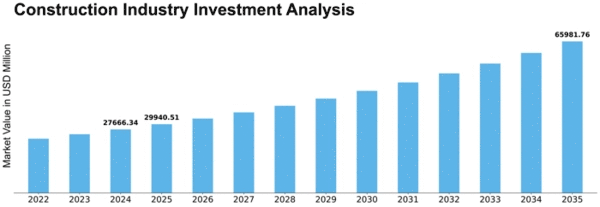

Construction Industry Investment Analysis Size

Construction Industry Investment Analysis Growth Projections and Opportunities

Indonesia's construction sector investment analysis is impacted by many market aspects that determine its landscape. Rapid urbanization and infrastructural development by the Indonesian government are key drivers. New residential, commercial, and public infrastructure projects are needed due to population growth and urbanization.

Indonesian building investment decisions are heavily influenced by economic reasons. Construction is a desirable investment due to the country's economic growth, stability, and GDP trends. Investors track economic factors like interest rates, inflation, and consumer spending to evaluate the economy and make construction investment decisions.

Government policies and regulations are key market elements affecting Indonesian construction investment analysis. Investor confidence is affected by the government's efforts to improve business conditions, streamline regulations, and incentivize construction projects. Investors actively monitor regulatory changes and government activities to assess the stability and possible returns of their Indonesian construction investments.

Technology in the building business affects investment analysis. Innovative construction processes, materials, and project management technology boost efficiency, lower costs, and boost project competitiveness. Investors like advanced technology projects because they are more likely to be finished on time and under budget, increasing ROI.

Environmental and sustainability factors are affecting construction investment decisions worldwide, including Indonesia. Climate change and environmental awareness are driving investors to green building and sustainable construction projects. Green and energy-efficient construction projects support global sustainability goals and attract socially responsible investors.

Construction investment analysis in Indonesia considers infrastructure gaps and regional demands. Given their development needs, certain regions may offer distinct opportunities, and investors may adjust their tactics to meet these market demands. Investors must understand local subtleties, infrastructural deficiencies, and demographic trends to choose and fund projects.

Risk assessment and management are crucial to construction investment analysis. Construction projects face regulatory concerns, delays, cost overruns, and geopolitical considerations. Investors carefully assess each investment opportunity's dangers and develop techniques to manage them.

Indonesian investment is shaped by construction industry competition. Investors evaluate construction companies' performance, market trends, and competitive landscape to find profitable investments. Strategic alliances with respected local construction firms can boost investor performance by using local expertise and negotiating regulatory difficulties.

Leave a Comment