Urbanization Trends

Rapid urbanization is a significant driver of the Construction Aggregate Market. As populations migrate to urban areas, the demand for housing, commercial spaces, and infrastructure increases dramatically. This urban expansion necessitates the use of aggregates for various construction applications, including residential buildings, roads, and public facilities. Recent data suggests that urban areas are expected to house nearly 70% of the world's population by 2050, leading to an unprecedented demand for construction materials. Consequently, the construction aggregate market is likely to experience substantial growth as it adapts to meet the needs of expanding urban environments.

Regulatory Frameworks

The regulatory environment surrounding construction practices significantly impacts the Construction Aggregate Market. Governments worldwide are implementing stricter regulations regarding environmental protection, resource extraction, and construction standards. Compliance with these regulations often necessitates the use of high-quality aggregates that meet specific criteria. As a result, companies are compelled to invest in better materials and processes to adhere to these standards. This regulatory pressure can lead to increased demand for premium aggregates, thereby influencing market dynamics. The construction aggregate market must navigate these complexities while ensuring compliance and maintaining profitability.

Sustainability Practices

Sustainability initiatives are increasingly influencing the Construction Aggregate Market. The construction sector is under pressure to adopt environmentally friendly practices, which includes the use of recycled aggregates and sustainable sourcing methods. Many construction companies are now prioritizing the use of recycled materials to reduce waste and lower their carbon footprint. Reports indicate that the market for recycled construction aggregates is projected to grow significantly, as more firms recognize the economic and environmental benefits of sustainable practices. This shift not only supports the Construction Aggregate Market but also aligns with broader global sustainability goals.

Technological Innovations

Technological advancements are reshaping the Construction Aggregate Market by enhancing efficiency and reducing costs. Innovations such as automated machinery, advanced crushing techniques, and improved logistics systems are streamlining aggregate production and distribution. These technologies enable companies to optimize their operations, leading to increased output and reduced waste. Furthermore, the integration of data analytics and artificial intelligence in supply chain management is allowing firms to better predict demand and manage inventory. As these technologies continue to evolve, they are likely to drive further growth in the Construction Aggregate Market, making it more competitive and responsive to market needs.

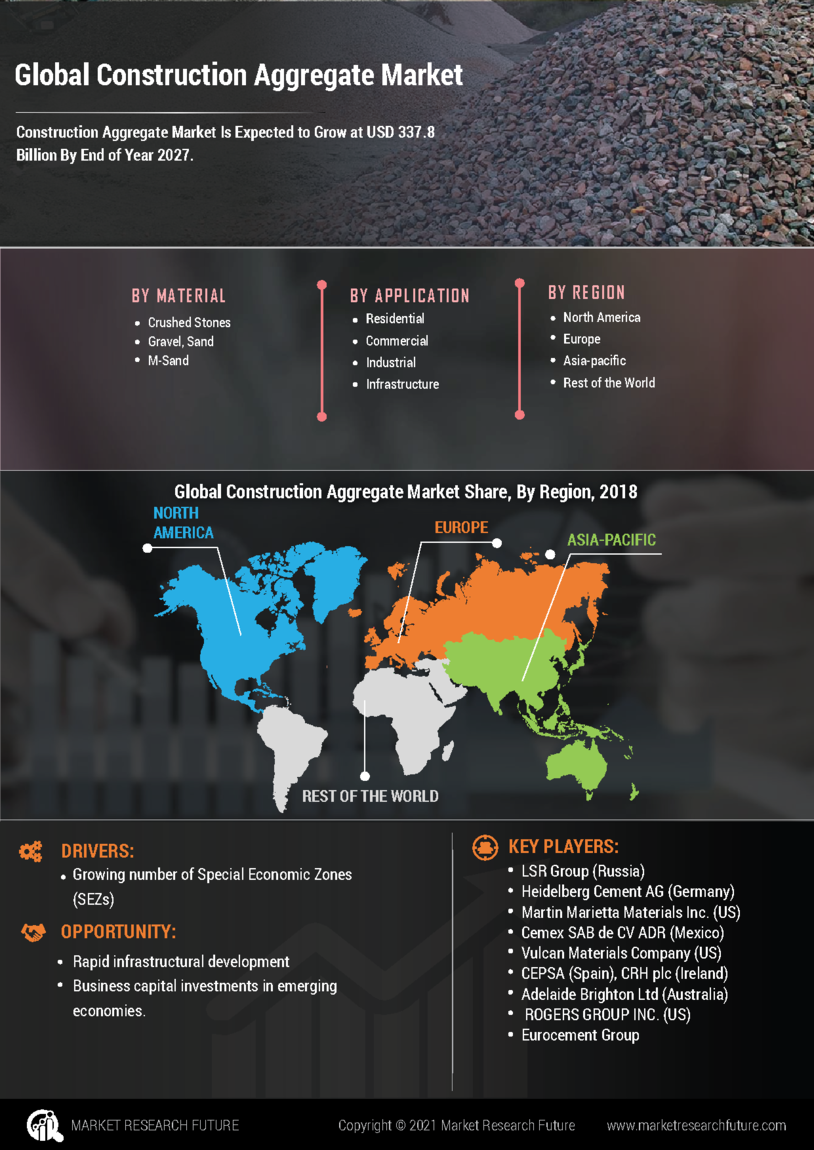

Infrastructure Development

The ongoing expansion of infrastructure projects plays a pivotal role in driving the Construction Aggregate Market. Governments and private entities are increasingly investing in roads, bridges, and public transportation systems to enhance connectivity and economic growth. For instance, the construction of new highways and urban transit systems necessitates substantial quantities of aggregates, which are essential for concrete and asphalt production. In recent years, the demand for aggregates has surged, with estimates indicating that the market could reach a value of over 500 billion USD by 2026. This trend underscores the critical importance of aggregates in supporting infrastructure development, thereby propelling the Construction Aggregate Market forward.