Market Share

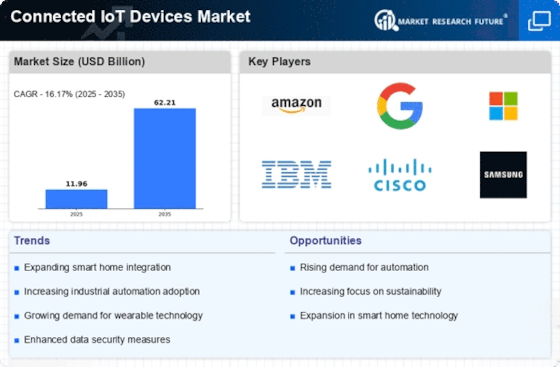

Connected IoT Devices Market Share Analysis

To obtain a competitive advantage in the highly competitive Connected IoT Devices Market, organizations utilize diverse market share positioning tactics. Differentiation is a common approach used by businesses to set their IoT devices apart from those of rivals by the provision of special features, enhanced functionality, or greater performance. This strategy helps businesses to command higher rates and draws in customers who are searching for cutting-edge solutions. For more intelligent personalized customer experiences, a business can concentrate on creating Internet of Things devices with state-of-the-art sensors or incorporating artificial intelligence. Forming strategic alliances and working together is another important tactic. Forming partnerships with other businesses, be they software developers, IT behemoths, or industry-specific partners, can greatly improve market placement in the connected world of the Internet of Things. By building extensive ecosystems, businesses may offer end-to-end solutions that seamlessly integrate a variety of platforms and devices. These strategic alliances solve a major issue in the IoT market by broadening the services provided and promoting interoperability. Through reaching more consumers, businesses frequently use market penetration to increase their market share. To make IoT devices more widely available, pricing and product positioning strategies are needed. Lowering entry barriers by offering reasonable prices or releasing device versions with less functionality might draw in a larger consumer base, particularly in regions where costs are a factor. This entails addressing issues, tailoring products to local tastes, and forming alliances with nearby companies. This tactic gives businesses a competitive edge in areas where IoT adoption is increasing by positioning them as early adopters in developing markets. One of the main pillars of competitive positioning for connected IoT devices is ongoing innovation. Companies must make research and development investments in order to stay ahead of the rapidly changing technology landscape and to anticipate and address changing consumer needs. Maintaining a competitive edge and winning back customers requires releasing new features on a regular basis, enhancing device performance, and following industry developments. An approach to productive market share positioning is expanding markets into emerging regions. Businesses strategically increase their presence in developing regions to take advantage of the unexplored markets there and increase their revenue.

Leave a Comment