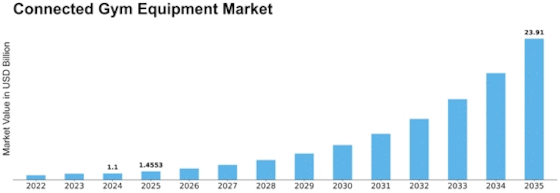

Connected Gym Equipment Size

Connected Gym Equipment Market Growth Projections and Opportunities

The market dynamics of connected gym equipment are driven by several key factors that shape its growth, innovation, and competitiveness in the fitness industry. One significant factor is the increasing adoption of digital technology and smart devices in fitness routines. As consumers seek more personalized, interactive, and data-driven workout experiences, there is a growing demand for connected gym equipment that integrates seamlessly with smartphones, wearables, and fitness apps. This convergence of fitness and technology enables users to track their workouts, monitor their progress, and access personalized training programs, enhancing motivation, accountability, and engagement in fitness activities.

Moreover, changing consumer lifestyles and preferences contribute to the market dynamics of connected gym equipment. With busier schedules, limited time for traditional gym visits, and a preference for flexible and convenient workout options, consumers are turning to home-based fitness solutions that offer convenience, accessibility, and customization. Connected gym equipment, such as smart treadmills, stationary bikes, rowing machines, and strength training equipment, allows users to work out from the comfort of their homes while still enjoying the benefits of personalized coaching, virtual classes, and real-time performance tracking.

Furthermore, advancements in sensor technology, artificial intelligence, and machine learning drive innovation within the connected gym equipment market. Manufacturers are incorporating sensors, cameras, accelerometers, and biometric trackers into fitness equipment to collect data on users' movements, performance metrics, and physiological responses. This data is then analyzed and processed using AI algorithms to provide insights, feedback, and personalized recommendations for optimizing workouts, improving technique, and achieving fitness goals. These intelligent features differentiate connected gym equipment from traditional fitness machines, offering users a more immersive, interactive, and effective workout experience.

Additionally, market dynamics within the connected gym equipment industry are influenced by the rise of subscription-based fitness services and digital platforms. Many connected fitness equipment manufacturers offer subscription services that provide access to on-demand workout content, virtual classes, live coaching sessions, and interactive training programs. These subscription models generate recurring revenue streams for manufacturers while offering users a comprehensive fitness solution that combines hardware, software, and content. As a result, consumers are increasingly adopting connected gym equipment as part of their holistic fitness routines, subscribing to platforms that offer a wide range of workouts and training modalities.

Regulatory standards and data privacy concerns also impact market dynamics in the connected gym equipment industry. Manufacturers must comply with industry regulations and standards related to product safety, electromagnetic interference, and data security to ensure the safety and integrity of their products. Moreover, with the collection and processing of user data becoming more prevalent in connected fitness ecosystems, manufacturers must prioritize data privacy, transparency, and user consent to build trust and mitigate risks associated with data breaches or misuse.

Consumer education and awareness play a crucial role in shaping market dynamics within the connected gym equipment industry. As the market evolves and new technologies emerge, manufacturers must educate consumers about the benefits, features, and capabilities of connected fitness equipment, as well as provide support and resources for integrating these technologies into their fitness routines. Moreover, manufacturers must address consumer concerns and misconceptions about connected fitness, such as cost, complexity, and data privacy, to increase adoption and market penetration.

Leave a Comment