Commercial Insulation Size

Commercial Insulation Market Growth Projections and Opportunities

The Commercial Insulation Market is influenced by a myriad of factors that collectively shape its dynamics. One of the primary drivers is the construction industry's health, as commercial insulation plays a crucial role in enhancing energy efficiency and reducing operational costs for buildings. As construction activities surge, the demand for commercial insulation materials follows suit. Government regulations and policies also significantly impact the market, with increasing emphasis on sustainable and energy-efficient construction practices. Stringent building codes and environmental standards drive the adoption of advanced insulation technologies, propelling market growth.

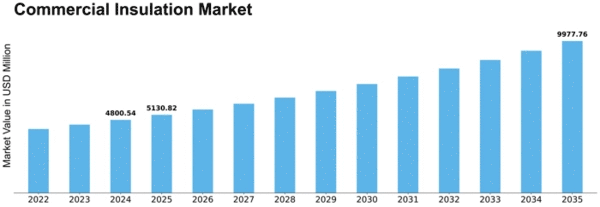

Commercial Insulation Market is projected to be worth USD 13 Billion by 2030, registering a CAGR of 6.1% during the forecast period (2022 - 2030).

The global economic landscape plays a pivotal role in shaping the commercial insulation market. Economic fluctuations and uncertainties can impact construction projects, leading to fluctuations in demand for insulation materials. Additionally, the cost of raw materials such as fiberglass, foam boards, and mineral wool directly affects the market dynamics. Fluctuations in raw material prices can influence product pricing and, consequently, market competitiveness.

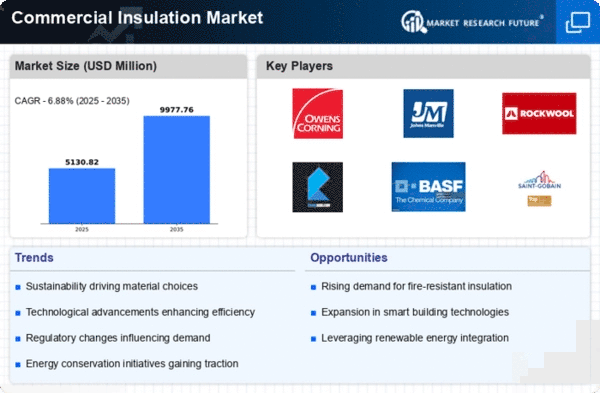

Technological advancements are another key factor influencing the commercial insulation market. Ongoing research and development efforts lead to the introduction of innovative insulation materials that offer improved thermal efficiency and environmental sustainability. The adoption of smart insulation solutions, integrating technology for better monitoring and control of thermal performance, is also on the rise.

Environmental awareness and the focus on sustainability are driving the demand for eco-friendly insulation materials. With increasing concerns about climate change, there is a growing preference for insulation products that have minimal environmental impact and are recyclable. Manufacturers in the commercial insulation market are responding to this trend by developing and promoting sustainable insulation solutions.

The energy sector's dynamics also play a crucial role in shaping the commercial insulation market. As energy prices fluctuate and concerns about energy conservation intensify, businesses and industries seek insulation solutions that contribute to energy efficiency and cost savings. This has led to a growing demand for insulation materials that provide superior thermal resistance, reducing the need for excessive heating or cooling.

The geographical landscape is yet another significant factor influencing the commercial insulation market. Regions experiencing extreme temperatures, whether hot or cold, drive higher demand for insulation materials to maintain comfortable indoor environments. Additionally, government initiatives and incentives aimed at promoting energy efficiency in specific regions can boost the adoption of commercial insulation.

The competitive landscape within the commercial insulation market is shaped by factors such as industry consolidation, market saturation, and the presence of key players. Mergers and acquisitions, as well as strategic partnerships, contribute to market dynamics, influencing pricing strategies and product innovation. The market's response to changing consumer preferences, such as the growing demand for green building materials, also shapes the competitive landscape.

The Commercial Insulation Market is a complex ecosystem influenced by a combination of factors. From economic conditions and technological advancements to environmental concerns and regional dynamics, each element contributes to the market's overall growth and trajectory. As the construction industry evolves and sustainability becomes a central focus, the commercial insulation market will continue to adapt to new challenges and opportunities, driving innovation and shaping the future of energy-efficient building practices.

Leave a Comment