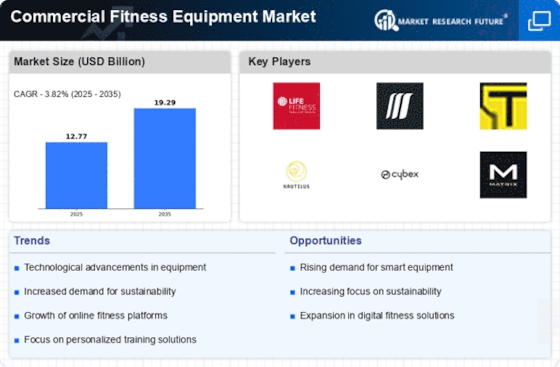

The Commercial Fitness Equipment Market is currently characterized by a dynamic competitive landscape, driven by a confluence of innovation, technological advancements, and evolving consumer preferences. Key players such as Life Fitness (US), Technogym (IT), and Nautilus (US) are strategically positioning themselves to capitalize on these trends. Life Fitness (US) emphasizes innovation in product design and user experience, while Technogym (IT) focuses on digital transformation and wellness integration. Nautilus (US), on the other hand, is enhancing its market presence through targeted partnerships and regional expansion, collectively shaping a competitive environment that is increasingly focused on delivering high-quality, technologically advanced fitness solutions.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to thrive, while larger companies leverage their scale to optimize operations and expand their market share. The collective influence of these key players fosters a competitive atmosphere where innovation and customer-centric strategies are paramount.

In August 2025, Life Fitness (US) launched a new line of smart cardio equipment that integrates AI-driven personal training features. This strategic move not only enhances user engagement but also positions the company at the forefront of the digital fitness revolution. By incorporating advanced technology into their products, Life Fitness (US) aims to attract a tech-savvy demographic, thereby expanding its customer base and reinforcing its market leadership.

In September 2025, Technogym (IT) announced a partnership with a leading health and wellness app to provide users with a seamless fitness experience. This collaboration underscores Technogym's commitment to digital integration and personalized fitness solutions. By aligning with a popular app, Technogym (IT) enhances its brand visibility and taps into a growing market of health-conscious consumers seeking comprehensive fitness solutions.

In July 2025, Nautilus (US) acquired a regional fitness equipment distributor to strengthen its supply chain and improve market access. This acquisition is strategically significant as it allows Nautilus (US) to enhance its distribution capabilities and respond more effectively to regional market demands. By consolidating its supply chain, Nautilus (US) is likely to improve operational efficiency and customer service, thereby gaining a competitive edge in the market.

As of October 2025, the competitive trends in the Commercial Fitness Equipment Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing product offerings and market reach. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition suggests that companies that prioritize these elements will likely emerge as leaders in the evolving fitness landscape.

.png)