Rising Threats and Conflicts

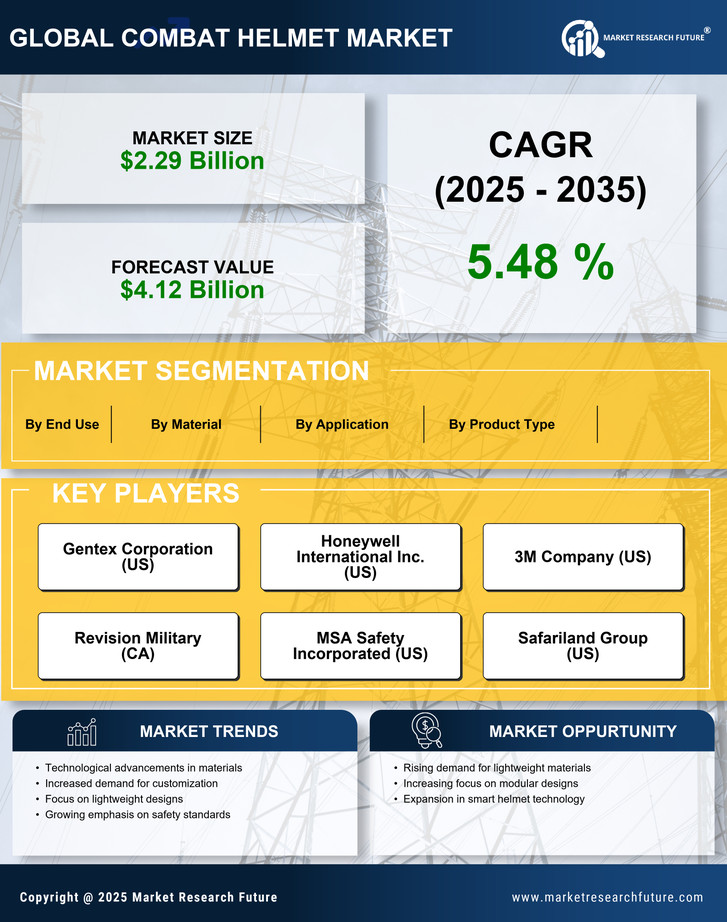

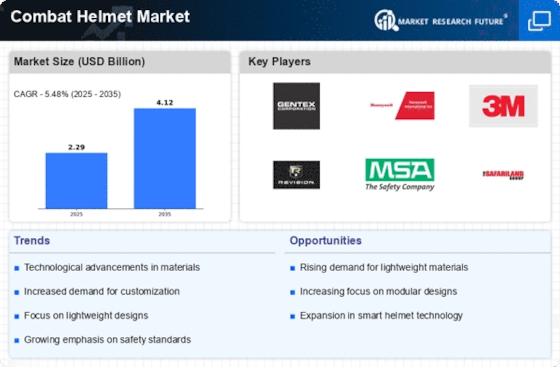

The Combat Helmet Market is significantly influenced by the rising threats and conflicts worldwide. Ongoing geopolitical tensions and the emergence of asymmetric warfare have heightened the need for enhanced soldier protection. As conflicts become more complex, the demand for advanced combat helmets that can withstand various ballistic threats is increasing. Reports suggest that regions experiencing unrest are witnessing a surge in procurement of protective gear, including helmets. This trend indicates a growing recognition of the importance of personal safety in combat scenarios, thereby driving the Combat Helmet Market forward.

Increased Military Expenditure

The Combat Helmet Market is experiencing a notable surge due to increased military expenditure across various nations. Governments are allocating substantial budgets to enhance their defense capabilities, which includes upgrading personal protective equipment. For instance, recent reports indicate that military budgets have risen by approximately 3-5% annually in several countries, reflecting a commitment to modernizing equipment. This trend is likely to drive demand for advanced combat helmets that offer superior protection and functionality. As military forces prioritize soldier safety, investments in research and development for innovative helmet designs are expected to escalate, further propelling the Combat Helmet Market.

Growing Demand for Law Enforcement Gear

The Combat Helmet Market is also witnessing growth due to the increasing demand for law enforcement gear. As public safety concerns rise, police and security forces are investing in protective equipment, including combat helmets. This trend is particularly evident in urban areas where law enforcement agencies face heightened risks. Reports indicate that the market for law enforcement protective gear is expanding, with a projected growth rate of around 4-6% annually. This growing demand is likely to influence the Combat Helmet Market, as manufacturers adapt their offerings to meet the specific needs of law enforcement personnel.

Technological Advancements in Materials

The Combat Helmet Market is benefiting from technological advancements in materials used for helmet production. Innovations such as lightweight composites and advanced ballistic materials are enhancing the protective capabilities of helmets while reducing weight. This is particularly crucial for military personnel who require mobility without compromising safety. Recent developments in materials science suggest that helmets can now offer improved impact resistance and comfort. As manufacturers continue to explore new materials, the Combat Helmet Market is likely to see a shift towards helmets that integrate these advancements, catering to the evolving needs of armed forces.

Focus on Soldier Well-being and Performance

The Combat Helmet Market is increasingly focusing on soldier well-being and performance. There is a growing recognition that helmets must not only provide protection but also enhance the overall performance of soldiers in the field. This includes considerations for comfort, weight distribution, and integration with communication systems. Research indicates that helmets designed with ergonomic principles can improve soldier effectiveness during operations. As military organizations prioritize the health and performance of their personnel, the Combat Helmet Market is expected to evolve, leading to the development of helmets that support both safety and operational efficiency.