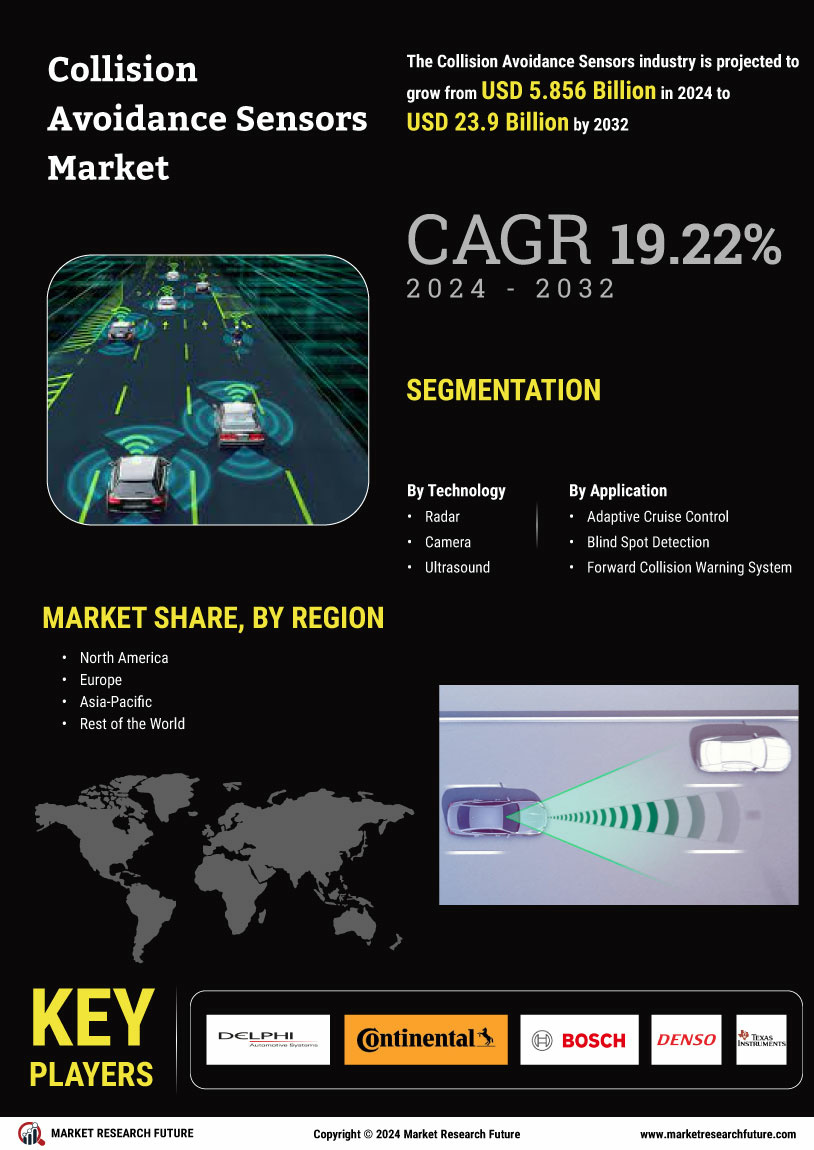

Consumer Awareness and Education

Consumer awareness regarding road safety and the benefits of collision avoidance systems is increasingly influencing the Collision Avoidance Sensors Market. As individuals become more educated about the advantages of these technologies, such as reduced accident rates and enhanced vehicle safety, the demand for vehicles equipped with collision avoidance sensors is likely to rise. Surveys indicate that over 60% of consumers prioritize safety features when purchasing a vehicle, which underscores the importance of educating the public about these systems. This growing awareness is expected to propel the Collision Avoidance Sensors Market, as manufacturers respond to consumer preferences by integrating advanced safety technologies into their offerings.

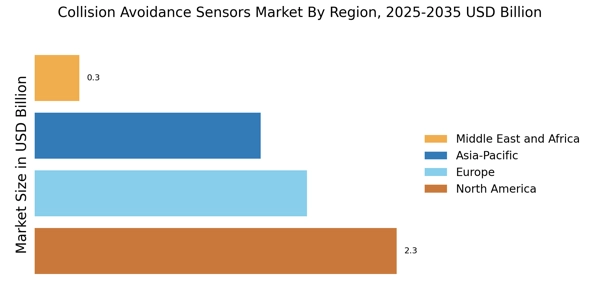

Government Initiatives and Regulations

Government initiatives aimed at enhancing road safety are significantly influencing the Collision Avoidance Sensors Market. Various countries are implementing stringent regulations that mandate the inclusion of advanced safety features in new vehicles. For instance, regulations requiring automatic emergency braking systems are becoming more prevalent, which directly boosts the demand for collision avoidance sensors. According to recent statistics, regions with strict safety regulations have witnessed a 25% increase in the adoption of these technologies. This regulatory push not only fosters innovation among manufacturers but also ensures that consumers benefit from safer vehicles, thereby propelling the Collision Avoidance Sensors Market forward.

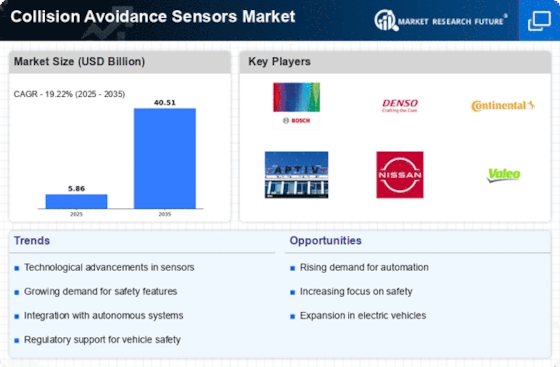

Rising Adoption of Autonomous Vehicles

The rising adoption of autonomous vehicles is significantly impacting the Collision Avoidance Sensors Market. As the automotive industry shifts towards automation, the need for reliable collision avoidance systems becomes paramount. Autonomous vehicles rely heavily on advanced sensor technologies to navigate safely and avoid obstacles. Market forecasts indicate that the autonomous vehicle segment will account for a substantial share of the Collision Avoidance Sensors Market by 2030. This trend is likely to accelerate investments in sensor technologies, as manufacturers strive to enhance the safety and reliability of autonomous systems, thereby driving the overall market growth.

Increasing Demand for Vehicle Safety Features

The Collision Avoidance Sensors Market is experiencing a notable surge in demand for advanced vehicle safety features. As consumers become more aware of road safety, manufacturers are compelled to integrate sophisticated collision avoidance systems into their vehicles. This trend is further supported by data indicating that vehicles equipped with such sensors can reduce accident rates by up to 30%. Consequently, automakers are investing heavily in research and development to enhance these technologies, which is likely to drive growth in the Collision Avoidance Sensors Market. Furthermore, the increasing number of road accidents globally underscores the necessity for effective safety measures, thereby propelling the adoption of collision avoidance sensors.

Technological Innovations in Sensor Technology

Technological innovations are playing a pivotal role in shaping the Collision Avoidance Sensors Market. The advent of advanced sensor technologies, such as LiDAR and radar, has enhanced the accuracy and reliability of collision avoidance systems. These innovations enable vehicles to detect obstacles and potential collisions with greater precision, thereby improving overall safety. Market data suggests that the integration of these advanced sensors can lead to a 40% reduction in collision-related incidents. As manufacturers continue to invest in cutting-edge technologies, the Collision Avoidance Sensors Market is poised for substantial growth, driven by the demand for more sophisticated and effective safety solutions.