Collaborative Robots Size

Market Size Snapshot

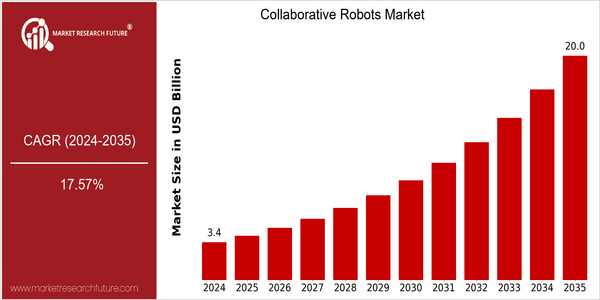

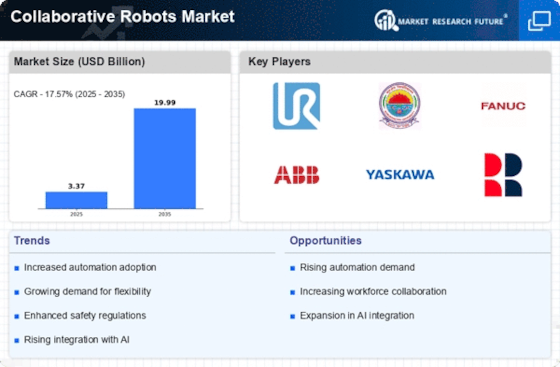

| Year | Value |

|---|---|

| 2024 | USD 3.37 Billion |

| 2035 | USD 19.99 Billion |

| CAGR (2025-2035) | 17.57 % |

Note – Market size depicts the revenue generated over the financial year

The worldwide market for collaborative robots is estimated to grow from $ 3.37 billion in 2024 to $ 19.98 billion by 2035. A CAGR of 17.57% for the period 2025–2035 reflects the strong demand for automation solutions across industries. The growing demand for cobots is driven by technological advancements in artificial intelligence, machine learning and sensors, which increase the capabilities and safety of robots in human-centric work environments. The growing need for operational efficiency, the automation trend in manufacturing and the trend towards flexible production systems are driving the market. ABB, KUKA and Universal Robots are among the leading companies in this innovation and are actively involved in strategic alliances and investments to enhance their product offerings. ABB has launched new cobots in recent years to meet the evolving needs of industries such as automotive and electronics. Universal Robots has also launched new models to meet the diverse needs of different industries. These strategic initiatives illustrate the dynamic cobot market and its potential to shape the future of work.

Regional Market Size

Regional Deep Dive

The global market for collaborative robots is experiencing significant growth, driven by the advancements in automation technology and the rising demand for flexible manufacturing solutions. North America has the highest number of market players and a strong industrial base, while Europe is focusing on regulatory frameworks that encourage automation. The Asia-Pacific region is a rapidly growing market, owing to the large manufacturing sector. The Middle East and Africa are slowly adopting these robots as part of their modernization efforts. Latin America, though lagging behind, is beginning to explore automation to enhance productivity. Each region has its own unique characteristics, influenced by economic conditions, the culture of automation, and the government’s initiatives to promote innovation.

Europe

- The European Union has launched initiatives to support the integration of collaborative robots in manufacturing, emphasizing sustainability and efficiency, which aligns with the region's green policies.

- Countries like Germany and Sweden are at the forefront of collaborative robot research, with companies such as KUKA and ABB developing advanced robotic solutions that enhance productivity in automotive and electronics sectors.

Asia Pacific

- China is rapidly increasing its investment in collaborative robots, with companies like DJI and Siasun Robotics leading the way in developing robots for various applications, including logistics and assembly.

- The region's cultural acceptance of automation, combined with government incentives for smart manufacturing, is driving the adoption of collaborative robots in industries ranging from electronics to food processing.

Latin America

- Brazil is beginning to see a rise in collaborative robot usage, particularly in the automotive and consumer goods sectors, as companies seek to modernize their production lines.

- Government programs aimed at boosting industrial competitiveness are encouraging local manufacturers to adopt collaborative robots, although challenges remain in terms of investment and training.

North America

- The U.S. is leading the charge in collaborative robot adoption, with companies like Universal Robots and Rethink Robotics innovating in user-friendly designs that cater to small and medium-sized enterprises.

- Recent regulatory changes in workplace safety standards are encouraging manufacturers to integrate collaborative robots, as they are designed to work alongside human operators without the need for extensive safety barriers.

Middle East And Africa

- Countries like the UAE are investing heavily in automation technologies, with initiatives such as the UAE Vision 2021 aiming to enhance productivity through the adoption of collaborative robots in various sectors.

- The region's unique labor market dynamics, characterized by a reliance on expatriate labor, is prompting companies to explore collaborative robots as a means to improve efficiency and reduce dependency on human labor.

Did You Know?

“Collaborative robots are designed to work safely alongside humans, and they can be programmed to perform a variety of tasks, from assembly to packaging, making them versatile tools in modern manufacturing.” — International Federation of Robotics (IFR)

Segmental Market Size

Collaborative robots, which are part of the automation industry, are a key part of the automation industry and are currently experiencing robust growth. In the industrial automation industry, the demand for the automation industry is mainly driven by the need for greater efficiency and rising labor costs in various industries. Moreover, advances in artificial intelligence and machine learning are enabling more sophisticated interactions between humans and robots, further driving the demand for cobots. In the United States, the use of cobots is currently at the stage of mass production, and the industry leaders such as Universal Robots and ABB have implemented cobots in various industries such as automobiles and electronics. , the main use of cobots is in the assembly, packaging and inspection of products. The cobots work with human operators to increase productivity and safety. The use of cobots is driven by macro-economic factors such as labor shortages and the trend of green production. Moreover, the application of vision and force-limited control is a major trend of the cobot. The evolution of the cobot, making it more flexible and convenient for various industrial applications.

Future Outlook

The Collaborative Robots Market is expected to grow at a CAGR of 17.57% from 2024 to 2035. This growth is driven by the increasing automation in various industries, such as manufacturing, logistics, and health care. In addition, the growing labor shortage has led to the increasing demand for the labor force, and the automation of human labor has become inevitable. Collaborative robots are becoming an essential tool for complementing human labor. By 2035, it is expected that the share of cobots in the manufacturing industry will increase from about 10% to about 30%. , indicating a significant shift towards human-robot collaboration in the workplace. Technological advancements such as improved artificial intelligence, machine learning, and enhanced safety features are expected to drive the market. These innovations will allow cobots to perform more complex tasks, adapt to dynamic environments, and work alongside humans with minimal supervision. Furthermore, supportive government policies to encourage automation and investment in research and development will also play an important role in shaping the market landscape. Industry 4.0 and the Internet of Things will also drive the demand for cobots in smart factories and drive the market. As the market evolves, all the participants in the industry must remain flexible and responsive to these trends in order to seize the opportunities in the cobot market.

Leave a Comment