Research Methodology on Coconut Oil Market

1. Introduction

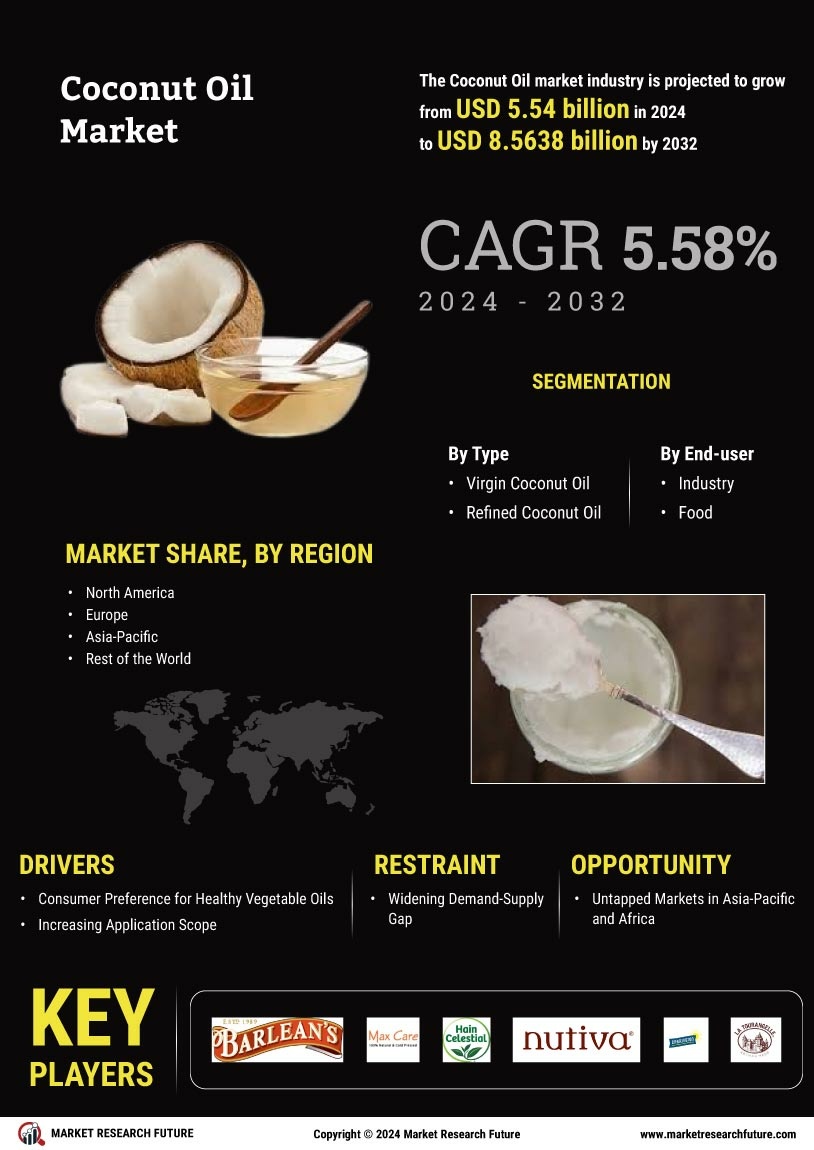

This research study provides an understanding of the Coconut Oil Market. The introduction to the report includes an overview of the global Coconut Oil Market, its industry scenario, opportunities and challenges. It also provides the market definition such as the Coconut Oil Market size, trends and scope.

2. Research Methodology

The research methodology used to develop the Coconut Oil Market report includes primary and secondary research and data collection. The primary research sources are government bodies, industry associations, leading companies and market reports. The secondary research includes inputs from papers, books, and the internet. The data collected from these sources and other available sources were triangulated and verified to arrive at accurate market estimations and projections along with the market forecast for 2023 to 2030.

a. Primary Research

Primary research was conducted by contacting numerous respondents from the Coconut Oil Market. The primary research method is based on the interviews conducted with industry leaders, manufacturers and stakeholders. The primary research was conducted to understand the strategies, trends, marketing channels and other information related to the Coconut Oil Market. Primary research also includes questionnaires administered to the respondents.

b. Secondary Research

Secondary research was conducted through the analysis of previous market reports related to the Coconut Oil Market, industry reports and historical data. The data collected from the secondary research was validated and verified with industry experts and subjected to further analysis and scrutiny.

3. Market Modelling

The market modelling methodology used in this study is an extensive market forecast modelling technique based on the combination of market data from primary and secondary sources. Various models such as Statistical Analysis System (SAS), PESTEL Analysis Model, and Porter's Five Forces Model were used to analyze the market data. The results of the market modelling were used to formulate market projections for the Coconut Oil Market.

4. Market Estimation

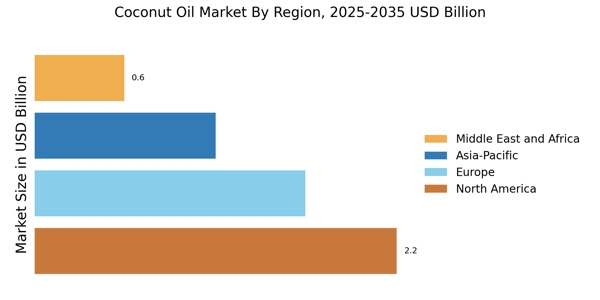

The market estimation of the Coconut Oil Market includes a detailed analysis of the market structure, market size, market share, market trends, macro and micro economic factors, market trends, and an estimation of the overall market opportunity. Market estimations were derived based on the market modelling results.

5. Market Forecast Model

The market forecast model used for the Coconut Oil Market includes a combination of both quantitative and qualitative factors. The market forecast model includes a top-down approach to estimating the market size. It takes into consideration the factors like market trends, market drivers, market constraints, industry structure, and macro and micro-economic factors. The market forecast model provides a comprehensive market estimate which can be used to make informed decisions.

6. Data Analysis

The data analysis was conducted to provide a thorough understanding of the Coconut Oil Market. This includes an analysis of market drivers, limitations, industry trends and competitive landscape. The market forecasts and estimations were also verified through in-depth data analysis.

7. Validation

The market analysis was validated with inputs from several industry experts, industry associations, market analysts and stakeholders. The inputs from these industry stakeholders were used to understand the trends and forecast the growth of the Coconut Oil Market from 2023 to 2030. The resulting estimates from the validation process were used to validate the market estimations and projections.

8. Summary

To summarize, the provided research methodology is an extensive market research approach based on primary and secondary research sources. This research methodology includes data collection, market modelling, market estimation, market forecast model, data analysis, and validation. This research methodology provides an in-depth understanding of the Coconut Oil Market and its associated opportunities and challenges.