- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

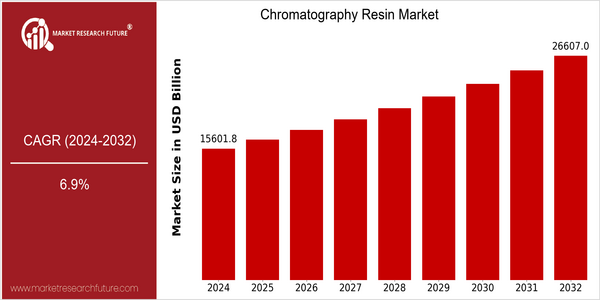

Chromatography Resin Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 15601.81 Billion |

| 2032 | USD 26607.04 Billion |

| CAGR (2024-2032) | 6.9 % |

Note – Market size depicts the revenue generated over the financial year

The chromatography resins market is expected to grow at a CAGR of 10.26% from 2024 to 2032, from a current market size of 15,601.81 million to 26,607.04 million by 2032. This CAGR is based on the forecast period of 2024 to 2032. The rising demand for chromatography resins is mainly due to the rapid growth in the biopharmaceuticals industry, where chromatography resins play a vital role in the separation and purification of complex biomolecules. The rising prevalence of chronic diseases is also driving the development of new therapeutics, which in turn requires the development of efficient chromatography techniques. Moreover, technological innovations, such as the development of high-performance resins and the automation of chromatography processes, are driving the market growth. Strategic initiatives by leading players, such as Merck KGaA, GE Healthcare, and Thermo Fisher Scientific, to enhance their market presence through strategic alliances, investments in R&D, and the launch of new products, are also driving the market growth. The recent collaborations between the industry players to improve the efficiency and sustainability of chromatography resins are an indication of the industry’s commitment to meet the evolving market requirements and regulatory standards.

Regional Deep Dive

The Chromatographic Resins Market is growing at a significant rate across the globe, owing to the rising demand for biopharmaceuticals, advancements in analytical techniques, and a rising emphasis on quality control in laboratories. Each region has its own characteristics, influenced by local regulations, economic conditions, and technological developments. North America leads in innovation and research, Europe is more concerned with regulations and sustainability, and Asia-Pacific is rapidly expanding as a result of rising healthcare expenditure. The Middle East and Africa are growing through the expansion of pharmaceutical manufacturing, and Latin America is focusing on improving laboratory and research capabilities.

North America

- The recent revision of the guidelines of the Food and Drug Administration of the United States for the manufacture of biological drugs has increased the need for high-quality chromatography resins.

- GE Health-care and Thermo Fisher Scientific are making significant investments in the development of new chromatographic resins that will enhance separation efficiency and reduce costs.

- Personalized medicine in North America has increased the use of chromatography methods and the demand for special resins for specific applications.

Europe

- The European Medicines Agency (EMEA) has imposed stricter regulations on the use of chromatography in the development of medicines, thereby pushing the pharmaceutical industry to use new resins that meet these requirements.

- Merck KGaA and Bio-Rad Laboratories have been working on sustainable chromatography solutions, based on bio-based resins, in line with the European Green Deal.

- The increasing trend towards contract manufacturing of biopharmaceuticals in Europe is increasing the demand for high-quality chromatography resins.

Asia-Pacific

- CHAPTER IV CHAPTER V CHAPTER VI CHAPTER VII CHAPTER VIII CHAPTER IX CHAPTER X The National Medical Product Administration Bureau of China has introduced new regulations on the use of chromatography in the testing of medicines, which have had a significant effect on the market for chromatography resins.

- The major companies, such as Tosoh and Mitsubishi, are increasing their production capacity in Asia to meet the demand for chromatography resins in the booming pharmaceutical industry.

- The development of the health industry in countries such as India and Japan is resulting in the increased use of chromatography methods and in turn, the market for chromatography resins.

MEA

- GCC countries are investing in the biotechnological and pharmaceutical industries, and this is expected to increase the demand for chromatography resins in drug development and quality control.

- Moreover, the African Society for Medical Laboratories (ASLM) is promoting the use of modern laboratory methods, including chromatography, which should stimulate the local resin market.

- It is the demand for good chromatographic resins that is causing the emergence of a demand for chromatographic resins.

Latin America

- The National Health Surveillance Agency (ANVISA) is strengthening the regulations relating to the manufacture of pharmaceutical products, which will result in an increase in the demand for chromatography resins that meet these standards.

- Local companies have begun to work together with foreign companies to develop laboratory capabilities. This has led to an increased use of chromatography and resins.

- Argentina and Chile are concentrating on the development of the biopharmaceutical industry. This has led to an increase in the development of chromatography technology, which has led to a rise in the local resin market.

Did You Know?

“CHROMATOGRAPHIC RESINS CAN BE SPECIFICALLY MANUFACTURED FOR CERTAIN APPLICATIONS, and one of these is to trap and retain more than ninety per cent of the substances which they contact, which is essential for the manufacture of biopharmaceuticals.” — Journal of Chromatography A

Segmental Market Size

The chromatography resins segment plays a key role in the chromatography market, which is currently growing steadily. Demand for chromatography resins is primarily being driven by the increasing demand for biopharmaceuticals, which requires high-purity separation processes, and by stricter regulations that demand reliable and efficient separation methods. Also, developments in resin technology, such as the development of high-performance affinity resins, are driving the market.

Today, the chromatography resin industry has entered a mature stage. The leading companies such as GE and Merck KGaA are using chromatography resins in their bioprocessing applications. The main application of chromatography resins is the separation of pharmaceutical products and the detection of heavy metals in the environment. The trend of sustainable development and the development of personalized medicine will accelerate the development of this industry. In addition, the monolithic and membrane chromatography resins introduced into the market will also lead the trend of the industry.

Future Outlook

The chromatography resins market is expected to show a CAGR of 6.9% from 2024 to 2032, with a market size of about $ 15.6 billion to $26.6 billion. The main reasons for this growth are the rising demand for biopharmaceuticals and the increasing use of chromatography techniques in many fields, such as drug development, environmental analysis and food safety testing. The demand for chromatography resins is further fueled by the growing biopharmaceutical industry. As the development of biological drugs continues, the need for more effective and efficient separation methods will increase.

Among the most important technological developments, the development of high-performance resins and the automation of chromatographic processes, are expected to increase the efficiency and effectiveness of separation methods. Furthermore, the quality and safety of pharmaceutical products will be ensured by regulatory frameworks that will stimulate the development of chromatography solutions. And the growing trend towards sustainable and environment-friendly resins is expected to have a significant impact on the market as manufacturers strive to comply with the world's sustainable development goals. The chromatography resin market will thus be driven by a combination of technological innovations, regulatory support and evolving industry needs.

Chromatography Resin Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.