Rising Labor Costs

The self checkout-in-retail market in China is experiencing a notable shift due to rising labor costs. As wages increase, retailers are compelled to seek cost-effective solutions to maintain profitability. The implementation of self checkout systems allows retailers to reduce the number of staff required at checkout points, thereby lowering operational expenses. This trend is particularly evident in urban areas where labor costs have surged by approximately 10% annually. Consequently, the The self checkout-in-retail market is likely to expand. Businesses are prioritizing automation to mitigate rising labor expenses.. Furthermore, the potential for enhanced efficiency through self checkout systems may attract more retailers to adopt this technology, thereby driving growth in the industry.

Consumer Demand for Speed

In the fast-paced retail environment of China, consumer demand for speed and efficiency is a significant driver of the self checkout-in-retail market. Shoppers increasingly prefer quick transactions, leading retailers to adopt self checkout systems that facilitate faster service. Data indicates that self checkout systems can reduce transaction times by up to 30%, enhancing customer satisfaction. This demand for speed is particularly pronounced among younger consumers, who value convenience and efficiency. As a result, retailers are likely to invest in self checkout technology to meet these expectations, thereby propelling the growth of the self checkout-in-retail market. The ability to streamline the shopping experience is becoming a competitive advantage for retailers in a crowded marketplace.

Technological Advancements

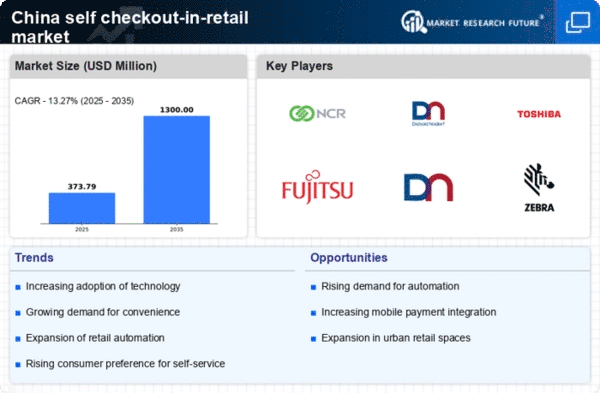

Technological advancements play a crucial role in shaping the self checkout-in-retail market in China. Innovations such as artificial intelligence, machine learning, and advanced scanning technologies are enhancing the functionality and user experience of self checkout systems. These advancements enable retailers to offer more intuitive interfaces and improve transaction accuracy, which is essential for customer satisfaction. The market is witnessing a surge in the adoption of these technologies, with projections indicating a growth rate of approximately 15% annually in the next five years. As retailers seek to leverage these advancements, the self checkout-in-retail market is poised for substantial growth, driven by the need for improved operational efficiency and customer engagement.

Expansion of Retail Formats

The expansion of various retail formats in China is driving the self checkout-in-retail market. With the rise of convenience stores, hypermarkets, and e-commerce platforms, retailers are increasingly adopting self checkout systems to cater to diverse shopping preferences. This trend is evident as convenience stores, which have proliferated in urban areas, often utilize self checkout to streamline operations and enhance customer experience. The self checkout-in-retail market is likely to benefit from this expansion, as retailers seek to implement flexible solutions that accommodate different shopping environments. The adaptability of self checkout systems makes them an attractive option for retailers looking to optimize their operations across various formats.

Increased Focus on Health and Safety

The self checkout-in-retail market in China is also influenced by an increased focus on health and safety. Retailers are adopting self checkout systems to minimize contact between customers and staff, thereby addressing consumer concerns regarding hygiene. This trend is particularly relevant in densely populated urban areas where the risk of contagion is perceived to be higher. By implementing self checkout solutions, retailers can provide a safer shopping environment, which is likely to enhance customer confidence and encourage store visits. As a result, the self checkout-in-retail market may experience growth as more retailers prioritize health and safety measures in their operations, aligning with consumer expectations.