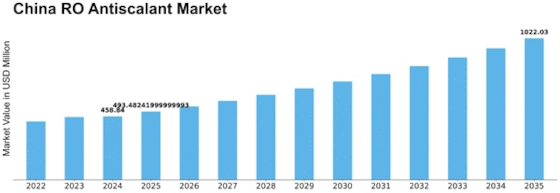

China Ro Antiscalant Size

China RO Antiscalant Market Growth Projections and Opportunities

The growth and significance of water treatment industry in the China Reverse Osmosis (RO) Antiscalant Market is influenced by many market factors. The rapid industrialization and urbanization of China are one of the main drivers of this market. Increasing urban populations and growing industries have resulted in increased demand for water treatment solutions with reverse osmosis playing a critical role. RO antiscalants contribute significantly to maintaining the performance efficiency of water treatment processes through preventing scaling and fouling of membranes in RO systems. Industrial activities increase together with demand for clean water, thus driving up the need for RO antiscalants in China.

China’s government policies and regulations shape the China RO Antiscalant Market. The Chinese government has put into place strict regulations regarding water quality and treatment standards because they recognize the importance of conserving water as well as protecting environment. Efficiency compliance demands that effective antiscalants be used in RO systems according to these laws. Government measures oriented towards addressing issues related to scarcity of water and improving its quality also enhance adoption rates for advanced water treatment technologies thus contributing to growth within the market segment.

The technological development in terms of processes for treating waters greatly affect China RO Antiscalant Market. Ongoing researches focus on improving performance as well as efficiency levels of RO antiscalants. Formulation and application innovations support production of more effective antiscalants by manufacturers capable of preventing scaling, prolonging life expectancy for RO membranes plus increasing overall system’s efficiency. Manufacturers must keep pace with these technological changes so as to respond to changing demands from their customers who are mostly based in China.

Water conservation awareness affects the market demand too. Concerns over shortages plus contamination have compelled various industries as well as municipalities within China to invest heavily into modernized forms of water treatments. The use, however, can be traced back when it was realized that scaling prevention is important since it helps maintain efficiency in reverse osmosis systems; thus, more RO antiscalants are being adopted as a part of integrated water treatment approach. The market is responding to increasing consciousness among the end-users about why scaling has to be prevented and why RO membrane life should be maintained.

Investment decision making and market dynamics for the China RO Antiscalant Market are also influenced by economic factors. This demand covers the entire spectrum of water treatment solutions including RO antiscalants as driven by economic growth, industrial activities and infrastructure development. Industries seeking reliable and sustainable water treatment options have pivotal considerations such as cost-effectiveness and efficiency of antiscalant products. On the other hand, economic stability will determine whether or not industries will find it necessary to invest in advanced water treatment technologies.

The China RO Antiscalant Market is affected by supply chain performance indicators that include raw material availability as well as logistic efficiencies. Sourcing raw materials for production of antiscalants and establishing efficient supply chains are crucial for meeting the ever-increasing market demands. Manufacturers must establish reliable supply chains capable of delivering these products fast enough to all water treatment facilities in China whenever needed.

Leave a Comment