Government Initiatives and Funding

Government initiatives and funding significantly impact the medical imaging-software market in China. The Chinese government has been actively promoting healthcare reforms and investing in advanced medical technologies to improve healthcare delivery. Initiatives aimed at enhancing healthcare infrastructure and increasing access to diagnostic services are likely to drive the adoption of medical imaging software. For instance, the government has allocated substantial budgets for upgrading hospital facilities and acquiring state-of-the-art imaging technologies. This financial support is expected to stimulate growth in the medical imaging-software market, as healthcare providers are encouraged to invest in modern imaging solutions that align with national health objectives.

Rising Demand for Diagnostic Imaging

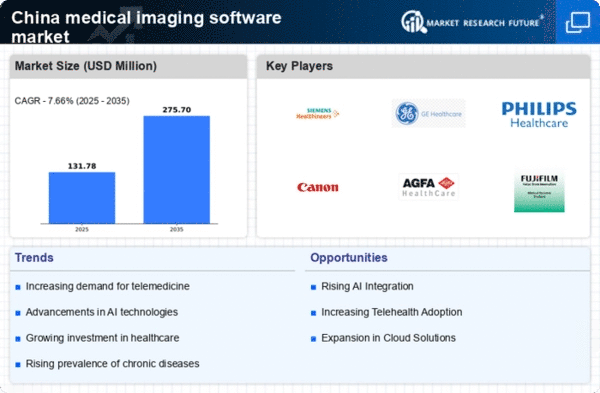

The medical imaging-software market in China experiences a notable surge in demand for diagnostic imaging solutions. This trend is driven by an increasing prevalence of chronic diseases and an aging population, which necessitates advanced imaging technologies for accurate diagnosis. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. Hospitals and clinics are investing in sophisticated imaging software to enhance diagnostic accuracy and improve patient outcomes. This growing demand for diagnostic imaging is likely to propel the medical imaging-software market forward, as healthcare providers seek to adopt innovative solutions that streamline workflows and enhance the quality of care.

Growing Focus on Personalized Medicine

The medical imaging-software market in China is increasingly influenced by the growing focus on personalized medicine. As healthcare shifts towards tailored treatment plans, the demand for imaging software that can provide detailed insights into individual patient conditions is rising. This trend is particularly relevant in oncology, where precise imaging is essential for effective treatment planning. The integration of imaging software with genomic data and other patient-specific information is likely to enhance diagnostic capabilities. Consequently, healthcare providers are investing in advanced imaging solutions that support personalized approaches, thereby driving growth in the medical imaging-software market.

Technological Advancements in Imaging Software

Technological advancements play a crucial role in shaping the medical imaging-software market in China. Innovations such as 3D imaging, enhanced visualization techniques, and integration with artificial intelligence are transforming the landscape of medical imaging. These advancements not only improve the accuracy of diagnoses but also facilitate faster processing times, which is essential in emergency medical situations. The market is witnessing a shift towards software that incorporates machine learning algorithms, enabling more precise image analysis. As a result, healthcare institutions are increasingly adopting these advanced imaging solutions, contributing to the overall growth of the medical imaging-software market.

Increased Investment in Healthcare Infrastructure

Increased investment in healthcare infrastructure is a key driver of the medical imaging-software market in China. The government and private sector are channeling significant resources into expanding and modernizing healthcare facilities, which includes the acquisition of advanced imaging technologies. This investment is aimed at improving healthcare access and quality, particularly in underserved regions. As hospitals and clinics upgrade their imaging capabilities, the demand for sophisticated medical imaging software is expected to rise. This trend indicates a robust growth trajectory for the medical imaging-software market, as enhanced infrastructure facilitates the adoption of innovative imaging solutions.