Emerging Biotech Startups

The emergence of biotech startups in China is significantly influencing the low pressure-liquid-chromatography market. These startups are often at the forefront of innovation, developing novel applications and technologies that leverage low pressure-liquid-chromatography for various purposes, including drug discovery and environmental analysis. In 2025, the number of biotech startups is projected to increase by 20%, creating a vibrant ecosystem that fosters competition and collaboration. As these companies seek to differentiate themselves, they are likely to invest in advanced chromatography solutions, driving demand within the market. This influx of new players not only stimulates innovation but also enhances the overall growth potential of the low pressure-liquid-chromatography market.

Rising Environmental Concerns

Environmental concerns are becoming increasingly prominent in China, leading to a heightened focus on sustainable practices within the low pressure-liquid-chromatography market. Regulatory bodies are emphasizing the need for environmentally friendly analytical methods, which is prompting companies to adopt low pressure-liquid-chromatography techniques that minimize waste and reduce solvent usage. This shift is likely to drive innovation in the market, as manufacturers develop more sustainable products and processes. Furthermore, the integration of green chemistry principles into chromatography practices may enhance the appeal of low pressure-liquid-chromatography solutions among environmentally conscious consumers and businesses. As a result, the market is expected to evolve in response to these environmental pressures, fostering growth and sustainability.

Growing Pharmaceutical Industry

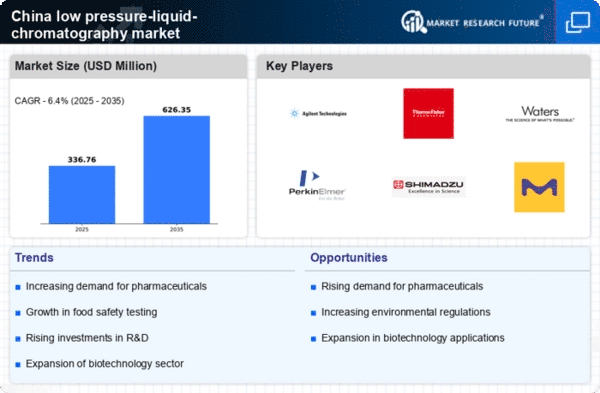

The pharmaceutical industry in China is expanding rapidly, which is positively impacting the low pressure-liquid-chromatography market. With the market size of the pharmaceutical sector projected to exceed $150 billion by 2025, the demand for advanced analytical techniques is increasing. Low pressure-liquid-chromatography plays a crucial role in drug development, quality control, and regulatory compliance. As pharmaceutical companies seek to streamline their processes and ensure product safety, the adoption of low pressure-liquid-chromatography technologies is likely to rise. This growth in the pharmaceutical sector not only drives demand for chromatography solutions but also encourages innovation and the development of new methodologies within the low pressure-liquid-chromatography market.

Expansion of Academic Institutions

The expansion of academic institutions in China is contributing to the growth of the low pressure-liquid-chromatography market. With an increasing number of universities and research centers focusing on life sciences and analytical chemistry, there is a growing demand for advanced chromatography equipment and training. In 2025, it is estimated that the number of academic programs related to analytical chemistry will increase by 15%, further driving the need for low pressure-liquid-chromatography technologies. This trend not only supports the education of future scientists but also fosters collaboration between academia and industry, leading to innovative applications and methodologies in the low pressure-liquid-chromatography market. The synergy between educational institutions and industry players is likely to enhance the overall market landscape.

Increased Research and Development Investment

The low pressure-liquid-chromatography market in China is experiencing a surge in research and development (R&D) investment. This trend is driven by both public and private sectors aiming to enhance analytical capabilities and improve separation techniques. In 2025, R&D spending in the life sciences sector is projected to reach approximately $20 billion, indicating a robust commitment to innovation. As a result, advancements in low pressure-liquid-chromatography technologies are likely to emerge, facilitating more efficient and accurate analyses. This investment not only supports the development of new applications but also enhances the overall competitiveness of the market, positioning China as a leader in chromatography solutions. The focus on R&D is expected to yield significant improvements in product offerings, thereby driving market growth.