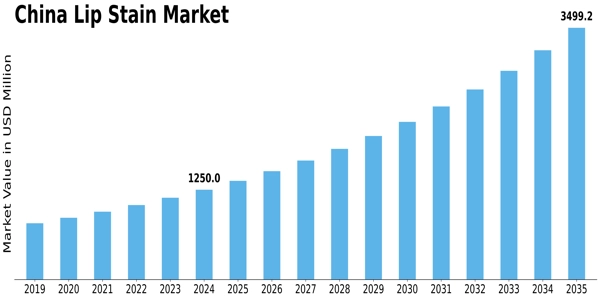

China Lip Stain Size

China Lip Stain Market Growth Projections and Opportunities

The China Lip Stain is anticipated to increase at a compound annual growth rate (CAGR) of 9.50% from its considerable value in 2023 to USD 29.4 billion by 2032. The key factors projected to fuel China's lip stain market include growing awareness of personal grooming, rising spending power of women, and appearance among young female consumers globally.

The lip stain market in China is shaped by a variety of market factors that reflect the preferences and dynamics of the beauty and cosmetics industry in the region. Consumer trends and preferences play a pivotal role, with the Chinese market known for its emphasis on skincare and natural-looking makeup. Lip stains, known for their long-lasting and lightweight formula, have gained popularity as they align with the desire for a subtle yet vibrant lip color. The influence of social media and beauty influencers further contributes to the trends, with consumers seeking products that are endorsed and showcased by popular figures.

Economic factors also impact the China lip stain market. The country's economic growth and increasing disposable income have led to a rising middle class with a greater capacity for discretionary spending on beauty products. This has created a growing market for cosmetics, including lip stains, as consumers have more purchasing power to invest in quality beauty items.

Cultural factors play a significant role in shaping the lip stain market in China. Traditional beauty standards, such as the preference for pale skin and subtle makeup, influence the types of products that gain popularity. Lip stains, with their natural finish and wide range of colors, cater to these preferences, allowing consumers to achieve a modern yet culturally appropriate look.

The influence of e-commerce and digital platforms is a crucial market factor. The Chinese beauty market has seen a significant shift towards online shopping, with platforms like Tmall and JD.com dominating the beauty and cosmetics sector. The accessibility and convenience of purchasing lip stains online have contributed to the growth of the market, allowing consumers to explore a wide range of products and brands with ease.

Brand reputation and marketing strategies are key considerations in the China lip stain market. Consumers in the region often value well-known and reputable brands. Effective marketing campaigns that highlight the benefits and features of lip stain products, along with endorsements from popular celebrities or influencers, can significantly impact consumer purchasing decisions in a competitive market.

Innovation and product formulation are critical factors in the lip stain market. Chinese consumers are increasingly interested in products that offer additional benefits, such as hydrating properties, sun protection, or even skincare ingredients. Brands that incorporate innovative formulations to meet these demands are likely to gain a competitive edge in the market.

Government regulations and compliance standards also influence the lip stain market in China. Adherence to safety and quality standards, as well as compliance with regulations related to cosmetic ingredients, is essential for brands operating in the beauty industry. Meeting these standards not only ensures consumer safety but also builds trust in the brand.

Cultural events and holidays can impact the demand for lip stain products. Special occasions, such as the Chinese New Year, may see a surge in cosmetic purchases as consumers seek new products to celebrate and enhance their appearance for festive events. Seasonal variations in makeup trends and color preferences also contribute to the dynamic nature of the lip stain market.

Leave a Comment