Increased Focus on Cybersecurity

As the edge infrastructure market expands in China, the focus on cybersecurity becomes increasingly critical. With the proliferation of connected devices, the potential for cyber threats escalates, prompting organizations to prioritize security measures. Edge computing can enhance security by processing data closer to its source, thereby reducing the risk of data breaches during transmission. Companies are likely to invest in advanced security solutions tailored for edge environments, which could lead to a substantial increase in the edge infrastructure market. It is estimated that investments in cybersecurity for edge computing could reach $5 billion by 2026, reflecting the growing awareness of security challenges in this evolving landscape.

Rise of Smart Cities Initiatives

China's commitment to developing smart cities is a pivotal driver for the edge infrastructure market. As urban areas become increasingly interconnected, the demand for efficient data management and processing solutions rises. Smart city initiatives often rely on edge computing to handle the vast amounts of data generated by sensors and IoT devices. This trend is expected to propel the edge infrastructure market, as municipalities invest in technologies that enhance public services and improve quality of life. The market could witness a growth rate of around 20% annually, fueled by government investments in smart city projects and the need for robust infrastructure to support these initiatives.

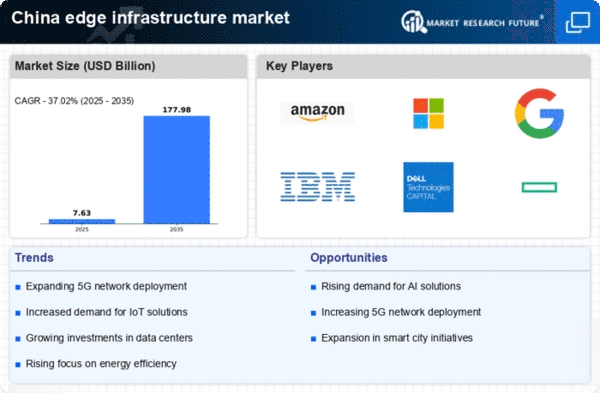

Expansion of 5G Network Infrastructure

The rollout of 5G networks across China is significantly influencing the edge infrastructure market. With 5G technology enabling faster data transmission and lower latency, businesses are increasingly adopting edge computing solutions to leverage these advancements. The integration of 5G is expected to enhance the performance of IoT devices, facilitating a more seamless connection between devices and edge servers. This transition is likely to drive the edge infrastructure market's growth, as organizations seek to optimize their operations and improve user experiences. Analysts predict that the edge infrastructure market could see an increase in investment by over $10 billion in the next few years, largely attributed to the 5G network expansion.

Adoption of Cloud Services and Hybrid Models

The edge infrastructure market in China is being shaped by the increasing adoption of cloud services and hybrid computing models. Organizations are recognizing the benefits of combining edge computing with cloud solutions to optimize their IT infrastructure. This hybrid approach allows for greater flexibility, scalability, and cost-effectiveness, enabling businesses to manage workloads more efficiently. As companies transition to this model, the edge infrastructure market is expected to experience robust growth, with projections indicating a potential market size increase of over $15 billion by 2027. This trend underscores the importance of integrating edge solutions with existing cloud services to meet the evolving demands of modern enterprises.

Growing Demand for Real-Time Data Processing

The edge infrastructure market in China is experiencing a notable surge in demand for real-time data processing capabilities. As industries increasingly rely on instantaneous data analytics, the need for localized computing resources becomes paramount. This trend is particularly evident in sectors such as manufacturing and logistics, where operational efficiency hinges on timely decision-making. According to recent estimates, the edge infrastructure market is projected to grow at a CAGR of approximately 25% over the next five years, driven by the necessity for low-latency data processing. Companies are investing heavily in edge computing solutions to enhance their operational agility and responsiveness, thereby solidifying their competitive edge in the market.