Expansion of Distribution Channels

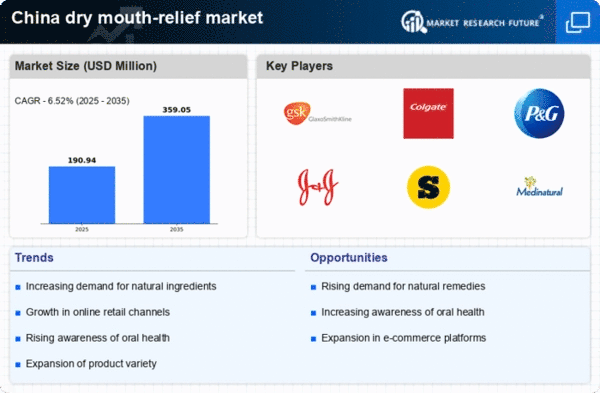

The expansion of distribution channels in China significantly impacts the dry mouth-relief market. With the rise of e-commerce platforms and online pharmacies, consumers have greater access to a variety of products. This shift allows for a broader reach, enabling manufacturers to cater to diverse consumer needs. Reports indicate that online sales of health products have surged by over 40% in recent years, reflecting changing shopping behaviors. Furthermore, traditional retail outlets are also adapting by increasing their product offerings. This multifaceted approach to distribution not only enhances product availability but also encourages competition among brands, ultimately benefiting consumers in the dry mouth-relief market.

Growing Interest in Natural Remedies

There is a notable shift towards natural and organic products within the dry mouth-relief market in China. Consumers are increasingly seeking solutions that align with their health-conscious lifestyles. This trend is evidenced by the rising sales of herbal and plant-based remedies, which have gained popularity due to perceived safety and efficacy. Market data suggests that natural products account for approximately 25% of the total sales in the dry mouth-relief market. As consumers become more educated about the ingredients in their products, the demand for transparency and quality increases. This inclination towards natural solutions is likely to shape product development and marketing strategies in the industry.

Rising Incidence of Dry Mouth Conditions

The increasing prevalence of dry mouth conditions in China is a primary driver for the dry mouth-relief market. Factors such as aging populations and lifestyle changes contribute to this trend. According to health statistics, approximately 30% of the elderly population experiences dry mouth symptoms, which can lead to discomfort and oral health issues. This growing demographic is likely to seek effective relief solutions, thereby expanding the market. Additionally, the rise in chronic diseases, such as diabetes, which can cause dry mouth, further fuels demand. As awareness of these conditions increases, consumers are more inclined to explore available products, thus propelling the dry mouth-relief market forward.

Impact of Oral Health Awareness Campaigns

Awareness campaigns focusing on oral health are playing a crucial role in driving the dry mouth-relief market. Government initiatives and non-profit organizations are increasingly promoting the importance of oral hygiene and the implications of dry mouth. These campaigns aim to educate the public about the causes and consequences of dry mouth, thereby encouraging individuals to seek relief options. As awareness grows, it is anticipated that more consumers will recognize the need for effective products, leading to increased market demand. The proactive approach taken by health authorities is likely to foster a more informed consumer base, which could positively influence purchasing behaviors in the dry mouth-relief market.

Technological Advancements in Product Development

Technological advancements are significantly influencing the dry mouth-relief market in China. Innovations in formulation and delivery methods are enhancing product effectiveness and consumer experience. For instance, the development of moisture-retaining ingredients and improved flavor profiles are making products more appealing. Additionally, advancements in packaging technology are ensuring better product preservation and convenience. As manufacturers invest in research and development, the introduction of new and improved products is expected to attract consumers. This focus on innovation not only meets the evolving needs of consumers but also positions brands competitively within the dry mouth-relief market.