Increasing Cancer Incidence

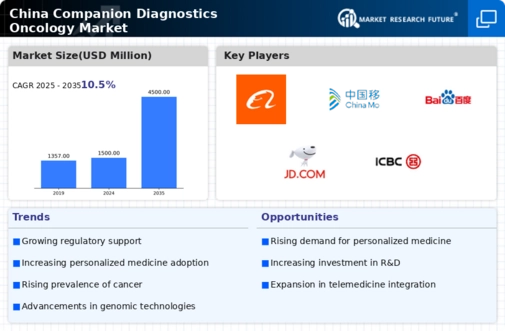

The rising incidence of cancer in China is a primary driver for the companion diagnostics market. According to the National Cancer Center, cancer cases are projected to reach approximately 4.6 million by 2025. This alarming trend necessitates the development of targeted therapies, which rely heavily on companion diagnostics to identify suitable patients for specific treatments. The growing burden of cancer is prompting healthcare providers to adopt precision medicine approaches, thereby increasing the demand for companion diagnostics. As a result, the market is expected to expand significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 15% over the next few years. This growth reflects the urgent need for effective diagnostic tools that can guide treatment decisions and improve patient outcomes in oncology.

Regulatory Framework Enhancements

The regulatory landscape for companion diagnostics in China is evolving, with recent enhancements aimed at streamlining the approval process for new diagnostic tests. The National Medical Products Administration (NMPA) has introduced guidelines that facilitate faster market access for innovative companion diagnostics. This regulatory support is crucial for fostering innovation and encouraging investment in the companion diagnostics-oncology market. The NMPA's initiatives are expected to reduce the time required for product approval by up to 30%, thereby accelerating the availability of new diagnostic solutions. As a result, companies are more likely to invest in research and development, leading to a broader range of diagnostic options for oncologists. This regulatory environment is likely to stimulate market growth and enhance the competitive landscape.

Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are propelling the companion diagnostics-oncology market forward in China. Innovations such as next-generation sequencing (NGS) have made it possible to analyze genetic mutations more efficiently and cost-effectively. This has led to the identification of biomarkers that are crucial for the development of targeted therapies. The Chinese government has been investing heavily in biotechnology, with funding exceeding $1 billion in recent years to support research and development in this field. As a result, the integration of these advanced technologies into clinical practice is expected to enhance the accuracy of cancer diagnostics, thereby driving market growth. The increasing availability of genomic data is likely to facilitate the development of personalized treatment plans, further solidifying the role of companion diagnostics in oncology.

Collaboration Among Industry Players

Collaboration among various stakeholders in the healthcare ecosystem is emerging as a key driver for the companion diagnostics-oncology market. Partnerships between pharmaceutical companies, diagnostic developers, and research institutions are becoming increasingly common in China. These collaborations aim to leverage combined expertise and resources to accelerate the development of innovative diagnostic solutions. For instance, joint ventures have been established to facilitate the sharing of data and technology, which can lead to the identification of new biomarkers. Market analysis suggests that such collaborations could potentially increase the efficiency of bringing new companion diagnostics to market by up to 25%. This collaborative approach not only enhances innovation but also ensures that the resulting diagnostic tools are aligned with clinical needs, thereby improving patient care in oncology.

Growing Awareness of Precision Medicine

There is a notable increase in awareness regarding precision medicine among healthcare professionals and patients in China, which is positively influencing the companion diagnostics-oncology market. Educational initiatives and campaigns have been launched to inform stakeholders about the benefits of personalized treatment approaches. This heightened awareness is leading to a greater acceptance of companion diagnostics as essential tools for optimizing cancer treatment. Market data indicates that the adoption rate of precision medicine in oncology has risen by approximately 20% in the past few years. As more healthcare providers recognize the value of tailored therapies, the demand for companion diagnostics is expected to surge, contributing to the overall growth of the market. This trend underscores the importance of educating both clinicians and patients about the potential benefits of precision medicine.