Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in China significantly impact the cardiac imaging-software market. The Chinese government has allocated substantial funding to enhance medical technology and promote the adoption of advanced imaging solutions. For instance, the Healthy China 2030 initiative emphasizes the importance of early diagnosis and treatment of cardiovascular diseases. This strategic focus is likely to drive investments in cardiac imaging software, as healthcare facilities strive to comply with national health objectives. The infusion of public funds into the healthcare sector is expected to bolster the market, facilitating the development and deployment of cutting-edge imaging technologies.

Integration of Artificial Intelligence

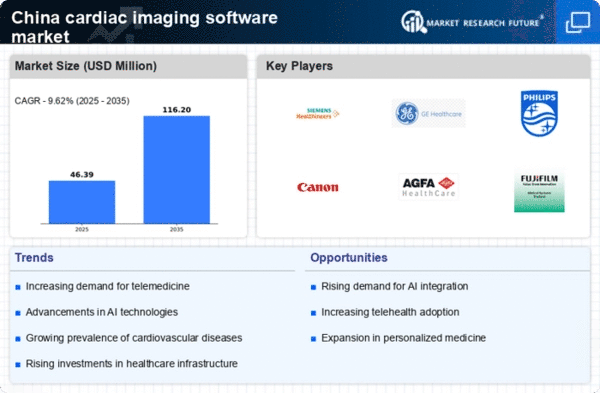

The integration of artificial intelligence (AI) into cardiac imaging software is transforming the landscape of diagnostics in China. AI algorithms enhance image analysis, enabling faster and more accurate interpretations of cardiac conditions. This technological advancement is particularly relevant in a country where the demand for efficient healthcare solutions is escalating. The cardiac imaging-software market is poised for growth as healthcare providers increasingly adopt AI-driven tools to streamline workflows and improve diagnostic accuracy. The potential for AI to reduce human error and enhance decision-making processes is likely to attract significant investment in this sector.

Rising Cardiovascular Disease Prevalence

The increasing prevalence of cardiovascular diseases in China is a primary driver for the cardiac imaging-software market. As the population ages and lifestyle-related health issues become more common, the demand for advanced imaging solutions rises. Reports indicate that cardiovascular diseases account for approximately 40% of all deaths in China, necessitating improved diagnostic tools. This trend compels healthcare providers to invest in sophisticated imaging software to enhance diagnostic accuracy and patient outcomes. Consequently, the cardiac imaging-software market is expected to experience substantial growth as hospitals and clinics seek to adopt innovative technologies to address this pressing health crisis.

Increasing Health Awareness and Education

The rising health awareness among the Chinese population is a crucial driver for the cardiac imaging-software market. As individuals become more informed about cardiovascular health, there is a growing demand for preventive measures and early detection of heart diseases. Educational campaigns and public health initiatives are fostering a culture of proactive health management, leading to increased utilization of cardiac imaging services. This heightened awareness is likely to stimulate market growth as healthcare providers expand their offerings to meet the needs of an informed patient base, thereby driving the adoption of advanced imaging software.

Growing Demand for Non-Invasive Procedures

The shift towards non-invasive diagnostic procedures is a notable trend influencing the cardiac imaging-software market. Patients and healthcare providers increasingly prefer non-invasive techniques due to their lower risk profiles and quicker recovery times. This preference is reflected in the rising adoption of imaging modalities such as echocardiography and cardiac MRI, which are integral to non-invasive diagnostics. As a result, the cardiac imaging-software market is likely to expand as manufacturers develop software solutions that enhance the capabilities of these non-invasive imaging techniques, ultimately improving patient care and diagnostic efficiency.