Growing Aging Population

The growing aging population in China is a significant driver of the breast imaging market. As the population ages, the incidence of breast cancer is expected to rise, necessitating more frequent screening and diagnostic services. With over 250 million individuals aged 60 and above, the demand for breast imaging services is likely to increase substantially. This demographic shift compels healthcare providers to enhance their imaging capabilities to cater to the needs of older women, who are at a higher risk for breast cancer. The breast imaging market is poised for growth as facilities expand their services and invest in advanced technologies to accommodate this aging population. Additionally, the focus on preventive healthcare among older adults may further stimulate demand for regular screenings.

Government Funding and Support

Government funding and support for healthcare initiatives significantly impact the breast imaging market. In recent years, the Chinese government has allocated substantial resources to improve cancer screening programs, particularly for breast cancer. This funding is directed towards enhancing healthcare infrastructure, increasing the availability of imaging services, and promoting public awareness campaigns. As a result, the breast imaging market is likely to benefit from increased accessibility to screening services, particularly in rural areas where healthcare resources are limited. The government's commitment to reducing breast cancer mortality rates through early detection is expected to drive the demand for imaging technologies. Consequently, this support creates a favorable environment for the growth of the breast imaging market.

Rising Incidence of Breast Cancer

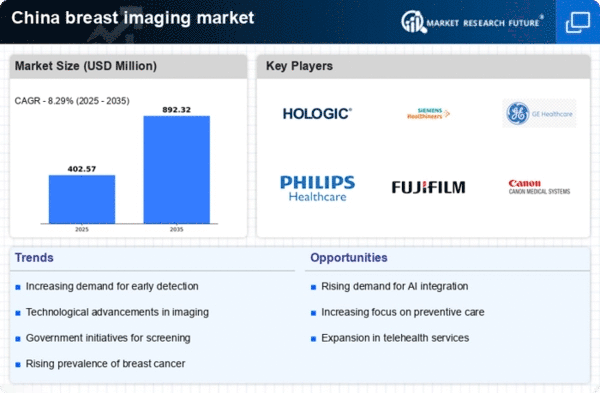

The increasing incidence of breast cancer in China is a primary driver for the breast imaging market. According to recent statistics, breast cancer cases have surged, with estimates suggesting that approximately 300,000 new cases are diagnosed annually. This alarming trend necessitates enhanced screening and diagnostic measures, thereby propelling the demand for advanced imaging technologies. The breast imaging market will expand as healthcare providers seek to implement more effective screening programs. Furthermore, the growing awareness among the population regarding early detection and treatment options is likely to contribute to the market's growth. As a result, the industry is witnessing a shift towards more sophisticated imaging modalities, which are essential for accurate diagnosis and improved patient outcomes.

Increased Health Insurance Coverage

Increased health insurance coverage in China is positively influencing the breast imaging market. As more individuals gain access to health insurance, the affordability of screening and diagnostic services improves. This trend is particularly relevant for breast imaging, where early detection is crucial for effective treatment. The expansion of insurance plans that cover breast imaging procedures encourages women to seek regular screenings, thereby increasing the overall demand for these services. Furthermore, the government's efforts to enhance health insurance schemes are likely to lead to a broader acceptance of breast imaging technologies. As a result, the breast imaging market is expected to experience growth, driven by the rising number of insured individuals seeking preventive care.

Technological Innovations in Imaging

Technological innovations play a crucial role in shaping the breast imaging market. The introduction of advanced imaging techniques, such as digital mammography, 3D tomosynthesis, and MRI, has revolutionized breast cancer detection. These technologies offer higher resolution images and improved diagnostic accuracy, which are vital for effective treatment planning. In China, the adoption of these innovations is on the rise, with a reported increase in the installation of advanced imaging equipment in hospitals and clinics. The market is projected to grow as healthcare facilities invest in state-of-the-art technologies to enhance their diagnostic capabilities. Moreover, the integration of artificial intelligence in imaging analysis is expected to further streamline workflows and improve patient care, indicating a promising future for the breast imaging market.