Rising Geriatric Population

The increasing geriatric population in China is a crucial driver for the bone biopsy market. As individuals age, they become more susceptible to various bone disorders, including osteoporosis and bone cancers. According to recent statistics, the population aged 65 and above is projected to reach approximately 300 million by 2025, which represents about 20% of the total population. This demographic shift is likely to escalate the demand for diagnostic procedures, including bone biopsies, as healthcare providers seek to address the growing prevalence of bone-related ailments. Consequently, the bone biopsy market is expected to expand significantly, driven by the need for accurate diagnosis and effective treatment plans tailored to the elderly population's unique health challenges.

Growing Awareness of Bone Health

There is a notable increase in public awareness regarding bone health in China, which serves as a vital driver for the bone biopsy market. Educational campaigns and health initiatives have been implemented to inform the population about the risks associated with bone disorders. As a result, individuals are more likely to seek medical advice and diagnostic services when experiencing symptoms related to bone health. This heightened awareness is expected to lead to an increase in the number of bone biopsy procedures performed, as healthcare providers emphasize the importance of early detection and intervention. Consequently, the bone biopsy market is poised for growth as more patients recognize the value of these diagnostic techniques.

Increased Healthcare Expenditure

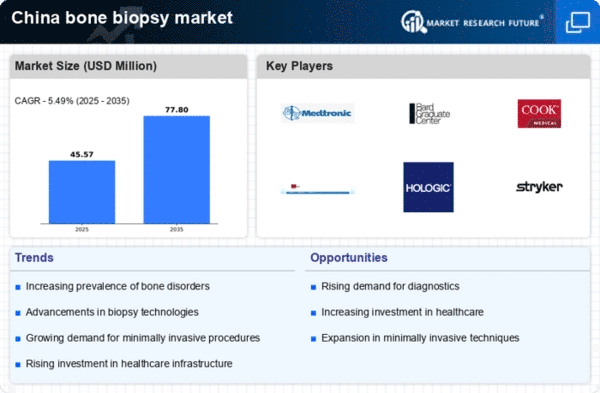

China's rising healthcare expenditure is another significant driver for the bone biopsy market. The government has been investing heavily in healthcare infrastructure and services, with spending projected to reach around 7% of GDP by 2025. This increase in funding is likely to enhance access to advanced diagnostic tools and technologies, including those used in bone biopsies. Furthermore, as patients become more aware of their health and the importance of early diagnosis, the demand for bone biopsy procedures is expected to rise. This trend indicates a growing market potential, as healthcare facilities are better equipped to provide comprehensive care, thereby fostering the development of the bone biopsy market.

Advancements in Biopsy Techniques

Innovations in biopsy techniques are significantly influencing the bone biopsy market in China. The development of minimally invasive procedures, such as image-guided biopsies, has improved patient outcomes and reduced recovery times. These advancements not only enhance the accuracy of diagnoses but also make the procedures more appealing to patients. As healthcare providers adopt these new technologies, the efficiency and effectiveness of bone biopsies are likely to improve, leading to an increase in their utilization. This trend suggests a positive outlook for the bone biopsy market, as the integration of advanced techniques continues to evolve and meet the demands of both patients and healthcare professionals.

Supportive Regulatory Environment

The regulatory environment in China is becoming increasingly supportive of advancements in medical technologies, including those related to the bone biopsy market. The government has implemented policies aimed at streamlining the approval process for new medical devices and procedures, which encourages innovation and enhances market growth. This supportive framework is likely to facilitate the introduction of novel biopsy technologies and improve existing practices. As regulatory bodies prioritize patient safety and efficacy, the bone biopsy market may experience accelerated growth, driven by the introduction of new products and services that meet the evolving needs of healthcare providers and patients alike.