Regulatory Landscape

The evolving regulatory landscape in China significantly impacts the bfsi security market. Authorities are implementing stringent regulations to safeguard consumer data and ensure financial stability. Compliance with these regulations often necessitates substantial investments in security infrastructure. For example, the introduction of the Personal Information Protection Law (PIPL) mandates that financial institutions enhance their data protection measures, thereby driving demand for advanced security solutions. As organizations strive to meet these regulatory requirements, the bfsi security market is likely to expand, with compliance-related expenditures projected to account for over 25% of total security budgets by 2026. This regulatory focus underscores the importance of robust security frameworks in the financial sector.

Rising Cyber Threats

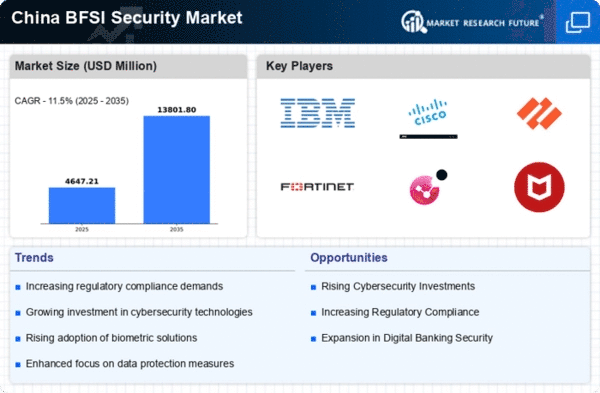

The bfsi security market in China is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Financial institutions are particularly vulnerable, with reports indicating that cyberattacks have surged by over 30% in recent years. This alarming trend compels banks and financial service providers to invest significantly in advanced security measures. As a result, the bfsi security market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% through 2026. The urgency to protect sensitive customer data and maintain trust is driving organizations to adopt robust cybersecurity frameworks, thereby enhancing the overall resilience of the BFSI security market.

Technological Advancements

The rapid evolution of technology is reshaping the bfsi security market in China. Innovations such as artificial intelligence (AI), machine learning, and blockchain are being integrated into security protocols to enhance threat detection and response capabilities. For instance, AI-driven analytics can identify anomalies in transaction patterns, potentially reducing fraud by up to 40%. As financial institutions increasingly leverage these technologies, the bfsi security market is expected to witness substantial growth, with investments in security solutions projected to reach $10 billion by 2025. This technological shift not only improves security but also streamlines operations, making it a critical driver for the bfsi security market.

Consumer Awareness and Demand

There is a growing awareness among consumers regarding the importance of data security in the financial sector, which is influencing the bfsi security market in China. As customers become more informed about potential risks, they are increasingly demanding higher levels of security from their financial service providers. This shift in consumer expectations is prompting institutions to prioritize security investments, with surveys indicating that over 70% of consumers consider security a key factor when choosing a financial service provider. Consequently, the bfsi security market is likely to see a surge in demand for comprehensive security solutions that address these consumer concerns, further driving market growth.

Investment in Digital Transformation

The ongoing digital transformation within the financial sector is a pivotal driver for the bfsi security market in China. As institutions transition to digital platforms, they face new security challenges that necessitate enhanced protective measures. The shift towards online banking and mobile payment solutions has led to an increase in cyber threats, prompting financial organizations to invest heavily in security technologies. It is estimated that digital transformation initiatives will account for nearly 40% of total security spending in the bfsi sector by 2025. This investment not only aims to mitigate risks but also to foster customer trust, thereby propelling the growth of the bfsi security market.