Growing Focus on Data Security

Data security concerns are becoming increasingly paramount in the audit software market in China. With the rise of cyber threats and data breaches, organizations are prioritizing the protection of sensitive financial information. In 2025, it is anticipated that investments in cybersecurity measures will increase by 20%, directly impacting the demand for secure audit software solutions. Companies are seeking software that not only facilitates compliance but also ensures robust data protection mechanisms. This growing focus on data security is likely to drive the adoption of audit software that incorporates advanced encryption and access control features. As a result, the audit software market is expected to evolve, with a greater emphasis on security functionalities to meet the needs of organizations in a rapidly changing digital landscape.

Rising Regulatory Requirements

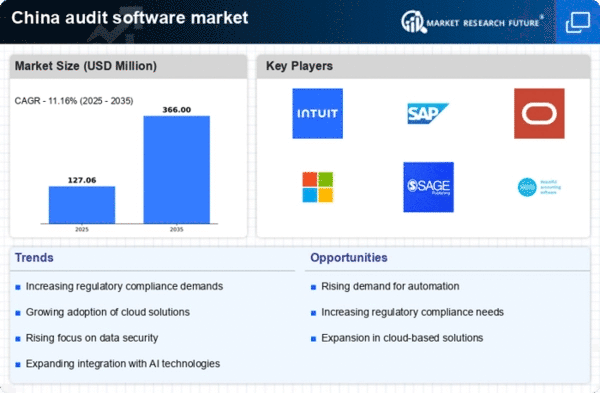

The audit software market in China is experiencing a notable surge due to increasing regulatory requirements imposed by the government. As businesses strive to comply with stringent financial regulations, the demand for robust audit solutions has escalated. In 2025, it is estimated that compliance-related expenditures will account for approximately 15% of total operational costs for medium to large enterprises. This trend indicates a growing recognition of the importance of audit software in ensuring adherence to legal standards, thereby driving market growth. Furthermore, the emphasis on transparency and accountability in financial reporting necessitates the adoption of advanced audit tools, which can streamline processes and enhance accuracy. Consequently, the audit software market is likely to expand as organizations prioritize compliance and risk mitigation strategies.

Increased Adoption of Cloud Solutions

The shift towards cloud-based solutions is reshaping the audit software market in China. Organizations are increasingly recognizing the benefits of cloud technology, including scalability, cost-effectiveness, and remote accessibility. By 2025, it is estimated that cloud-based audit software will represent over 40% of the total market share, as businesses seek to streamline their operations and reduce IT infrastructure costs. This trend is particularly relevant for small and medium-sized enterprises (SMEs) that may lack the resources for extensive on-premises systems. The flexibility offered by cloud solutions allows for real-time collaboration and data sharing, which enhances the overall audit process. Consequently, the growing adoption of cloud technology is likely to propel the audit software market forward, as organizations embrace digital transformation.

Technological Advancements in Software

Technological advancements are significantly influencing the audit software market in China. The integration of artificial intelligence (AI) and machine learning (ML) capabilities into audit solutions is transforming traditional practices. These technologies enable real-time data analysis, anomaly detection, and predictive analytics, which enhance the efficiency and effectiveness of audits. In 2025, it is projected that AI-driven audit software will capture around 30% of the market share, reflecting a shift towards more sophisticated tools. As organizations seek to leverage technology for improved decision-making and operational efficiency, the demand for innovative audit software solutions is expected to rise. This trend underscores the importance of staying abreast of technological developments to remain competitive in the audit software market.

Demand for Enhanced Reporting Capabilities

The demand for enhanced reporting capabilities is a driving force in the audit software market in China. Organizations are increasingly seeking solutions that provide comprehensive reporting features, enabling them to generate detailed insights and analytics. In 2025, it is projected that the market for audit software with advanced reporting functionalities will grow by 25%, as businesses recognize the value of data-driven decision-making. Enhanced reporting capabilities facilitate better communication with stakeholders and regulatory bodies, thereby improving transparency and accountability. As companies strive to optimize their audit processes and deliver actionable insights, the emphasis on sophisticated reporting tools is likely to shape the future of the audit software market.