Increased Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the 5g infrastructure market in China. With an estimated 1.5 billion IoT devices expected to be connected by 2025, the demand for robust 5g networks is becoming increasingly critical. These devices require low latency and high bandwidth, which 5g technology can provide. Industries such as manufacturing, healthcare, and smart cities are leveraging IoT to enhance operational efficiency and improve service delivery. Consequently, the growth of IoT applications is likely to drive investments in 5g infrastructure, as companies seek to capitalize on the benefits of connected technologies.

Government Initiatives and Support

The Chinese government plays a pivotal role in the 5g infrastructure market through various initiatives and policies aimed at promoting technological advancement. With substantial investments, the government has allocated over $20 billion to enhance 5g networks, which is expected to cover 80% of urban areas by 2025. This support not only accelerates deployment but also fosters innovation in related sectors. The government's commitment to digital transformation is evident in its strategic plans, which emphasize the importance of 5g technology in driving economic growth. As a result, the is likely to experience robust growth, driven by favorable regulatory frameworks and financial backing.

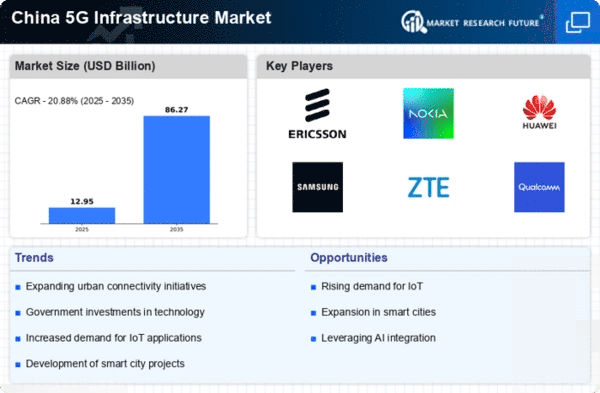

Competitive Landscape and Market Dynamics

The competitive landscape of the 5g infrastructure market in China is characterized by intense rivalry among major telecommunications companies. Key players are investing heavily in research and development to gain a competitive edge, with expenditures exceeding $15 billion annually. This competition is fostering innovation and driving down costs, which can benefit consumers and businesses alike. Additionally, partnerships and collaborations among industry stakeholders are becoming more common, as companies seek to enhance their service offerings and expand their market reach. As the competitive dynamics evolve, the 5g infrastructure market is poised for substantial growth, driven by both technological advancements and strategic alliances.

Rising Demand for High-Speed Connectivity

The demand for high-speed connectivity in China is surging, significantly impacting the 5g infrastructure market. With the increasing number of internet users, projected to reach 1 billion by 2025, the need for faster and more reliable networks becomes paramount. Industries such as entertainment, e-commerce, and telecommunication are pushing for enhanced connectivity to support their operations. The 5g infrastructure market is expected to grow at a CAGR of 30% over the next five years, driven by this escalating demand. As consumers and businesses alike seek seamless online experiences, the infrastructure supporting 5g technology must evolve to meet these expectations.

Technological Advancements in Telecommunications

Technological advancements are a key driver of the 5g infrastructure market in China. Innovations in network architecture, such as the development of Massive MIMO and beamforming technologies, are enhancing the efficiency and capacity of 5g networks. These advancements enable operators to provide better service quality and coverage, which is crucial for urban areas with high population density. Furthermore, the integration of artificial intelligence and machine learning in network management is streamlining operations and reducing costs. As these technologies continue to evolve, they are likely to propel the 5g infrastructure market forward, creating new opportunities for growth and development.