Increased Investment in R&D

Investment in research and development (R&D) within the 3d machine-vision market is on the rise in China. Companies are allocating significant resources to innovate and enhance their machine vision technologies. This trend is driven by the need to stay competitive in a market characterized by rapid technological advancements. In 2025, R&D spending in this sector is expected to increase by 10%, reflecting a commitment to developing more sophisticated algorithms and hardware. Enhanced capabilities, such as improved image processing and machine learning integration, are anticipated to drive further adoption of 3D machine vision systems across various sectors, including manufacturing and healthcare.

Growing Adoption in Manufacturing

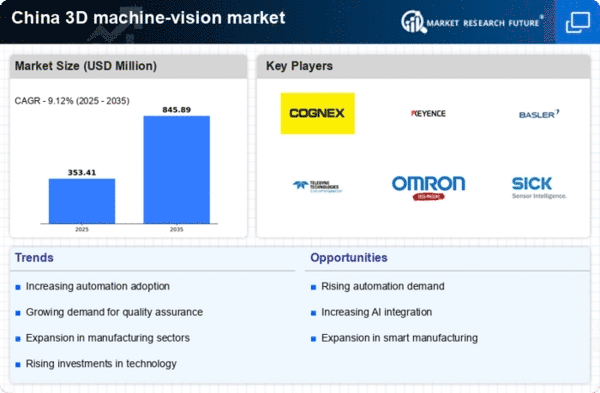

The manufacturing sector in China is increasingly adopting 3D machine-vision systems to streamline operations and improve productivity. As factories modernize and embrace Industry 4.0 principles, the integration of advanced technologies becomes essential. The 3d machine-vision market is projected to grow by 12% in 2025, largely due to the demand for automation and precision in manufacturing processes. These systems enable real-time monitoring and quality assurance, which are critical for maintaining high production standards. Furthermore, the ability to integrate with existing manufacturing systems enhances their appeal, making them a preferred choice for manufacturers looking to optimize their operations.

Rising Demand for Quality Control

The 3d machine-vision market in China experiences a notable surge in demand for quality control solutions across various industries. As manufacturers strive to enhance product quality and reduce defects, the integration of 3D machine vision systems becomes increasingly vital. In 2025, the market is projected to grow by approximately 15%, driven by the need for precise inspection processes. Industries such as automotive, electronics, and pharmaceuticals are particularly focused on implementing these technologies to ensure compliance with stringent quality standards. The ability of 3D machine vision systems to provide accurate measurements and detect anomalies in real-time positions them as essential tools for manufacturers aiming to maintain competitive advantages in a rapidly evolving market.

Support from Government Initiatives

Government initiatives in China are playing a pivotal role in the growth of the 3d machine-vision market. Policies aimed at promoting technological innovation and automation are encouraging businesses to adopt advanced machine vision systems. In 2025, government funding for technology development is expected to increase by 15%, providing financial support for companies investing in 3D machine vision technologies. This support not only fosters innovation but also helps reduce the financial barriers for small and medium-sized enterprises (SMEs) looking to implement these systems. As a result, the 3d machine-vision market is likely to benefit from a broader adoption across various industries, enhancing overall market growth.

Expansion of E-commerce and Logistics

The rapid expansion of e-commerce in China significantly influences the 3d machine-vision market. With online retail sales projected to reach over $2 trillion by 2025, logistics and warehousing operations are under pressure to optimize efficiency. 3D machine vision systems facilitate automated sorting, packaging, and inventory management, thereby enhancing operational workflows. The integration of these systems allows for improved accuracy in order fulfillment and inventory tracking, which is crucial for meeting consumer expectations. As logistics companies increasingly adopt advanced technologies, the 3d machine-vision market is likely to see a substantial increase in demand, potentially exceeding 20% growth in the coming years.