Top Industry Leaders in the CBD-Infused Confectionery Market

Strategies Adopted by CBD-Infused Confectionery Key Players

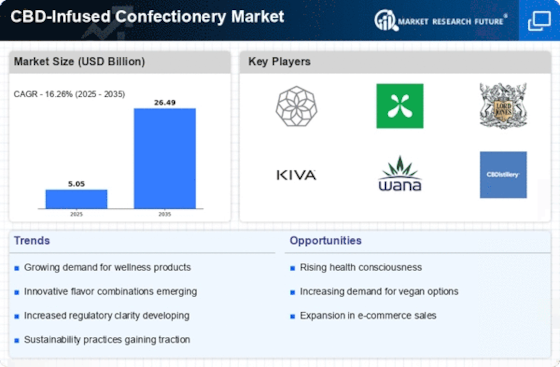

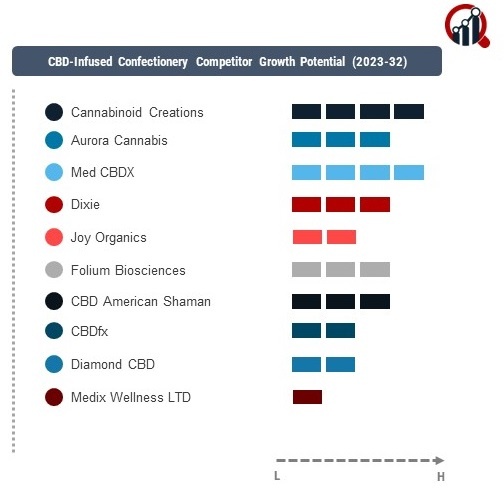

The competitive landscape of the CBD-infused confectionery market is witnessing dynamic shifts as consumer preferences evolve, regulatory frameworks adapt, and new entrants bring innovation to the sector. Key players in this market have been strategically positioning themselves to capitalize on the growing demand for CBD-infused products. As of 2023, several factors contribute to the overall competitive scenario, including key players, their strategies, market share analysis, new and emerging companies, industry news, investment trends, and recent developments.

Key Players:

- General Mills Inc.

- Amway

- Conagra Brands Inc.

- Cargill Incorporated

- Abbott Laboratories

- Kraft Foods Group Inc.

- The Coca-Cola Company

- PepsiCo Inc.

- Atkins Nutritionals Inc.

- Brunswick Corporation

Key players in the CBD-infused confectionery market have adopted various strategies to gain a competitive edge. Product diversification, strategic partnerships, and mergers and acquisitions have been prevalent. Larger companies have introduced CBD-infused versions of their popular confectionery brands, while smaller, specialized firms focus on creating unique and niche products. Partnerships between CBD companies and established confectionery manufacturers have facilitated market penetration, allowing both parties to benefit from each other's expertise.

Factors for Market Share Analysis:

Market share analysis in the CBD-infused confectionery sector takes into account several factors. Brand recognition, distribution channels, product innovation, and compliance with evolving regulatory standards are crucial elements determining market share. Additionally, consumer trust, which is often influenced by factors such as product quality, transparency, and adherence to safety standards, plays a significant role in establishing and maintaining market share.

New and Emerging Companies:

The CBD-infused confectionery market is witnessing the emergence of new players aiming to carve out their niche. These companies often bring innovative products, unique formulations, or sustainable practices to differentiate themselves. Emerging players such as SweetLeaf and Chill Gummies have gained attention for their focus on organic ingredients, catering to a growing segment of health-conscious consumers seeking CBD-infused alternatives.

Industry News and Current Company Updates:

Industry news and updates play a pivotal role in shaping the competitive landscape. Ongoing changes in regulations, market trends, and consumer preferences impact companies differently. Regular updates on product launches, expansions, and collaborations help stakeholders stay informed about the dynamic nature of the CBD-infused confectionery market.

Investment Trends:

The CBD-infused confectionery market has attracted significant investments from venture capital firms and strategic investors. Funding trends often reflect the perceived potential and growth prospects of the sector. Investors are keenly watching companies that demonstrate strong market positioning, innovative product offerings, and the ability to navigate the complex regulatory landscape. The infusion of capital allows companies to scale operations, invest in research and development, and expand their market presence.

Overall Competitive Scenario:

The overall competitive scenario in the CBD-infused confectionery market is marked by a balance between traditional confectionery giants, CBD-focused companies, and newer entrants. The landscape is dynamic, with companies adapting to changing consumer preferences and regulatory environments. Market consolidation through mergers and acquisitions is a prevalent trend as larger players seek to strengthen their portfolios and market presence. At the same time, smaller, innovative companies continue to disrupt the market with unique offerings.

Recent Developments

The CBD-infused confectionery market witnessed several noteworthy developments. Hershey's, a leading player in the confectionery industry, expanded its CBD product line with the introduction of CBD-infused chocolate bars, capitalizing on the growing demand for indulgent yet wellness-oriented treats. Concurrently, Charlotte's Web, a dedicated CBD company, entered into a strategic partnership with a major retail chain to enhance its product distribution.

Additionally, regulatory developments played a crucial role in shaping the industry landscape. The FDA's clarification on CBD regulations provided a framework for companies to navigate compliance issues, influencing product formulations and marketing strategies. This regulatory clarity contributed to increased investor confidence, resulting in additional funding for several CBD-infused confectionery startups.

- Beta

Beta feature