Rising Vehicle Production

The continuous increase in vehicle production is another significant driver for the Global Catalytic Converter Market. As economies recover and consumer demand for automobiles rises, manufacturers are ramping up production to meet this demand. In 2025, the global vehicle production is expected to reach approximately 90 million units, which directly correlates with the need for catalytic converters. Each vehicle produced requires a catalytic converter to comply with emission standards, thereby driving the market. Furthermore, the shift towards more fuel-efficient and environmentally friendly vehicles is likely to enhance the demand for advanced catalytic converter technologies. This trend suggests a sustained growth trajectory for the auto catalytic converter market, as manufacturers adapt to evolving consumer preferences and regulatory landscapes.

Technological Innovations

Technological innovations in catalytic converter design and materials are poised to significantly impact the Catalytic Converter Industry. Advances in catalyst formulations, such as the development of more efficient precious metal catalysts, are enhancing the performance and durability of catalytic converters. These innovations not only improve emission control but also reduce the overall cost of production. For instance, the introduction of new substrate materials can lead to lighter and more compact designs, which are increasingly favored in modern vehicles. As manufacturers invest in research and development to create cutting-edge solutions, the market is likely to witness a surge in demand for innovative catalytic converters. This focus on technology is expected to drive market growth, with projections indicating a potential increase in market size by 10% over the next five years.

Sustainability Initiatives

The growing emphasis on sustainability initiatives is influencing the Catalytic Converter Sector in various ways. As consumers and manufacturers alike become more environmentally conscious, there is an increasing demand for catalytic converters that not only meet regulatory standards but also contribute to sustainability goals. This includes the recycling of precious metals used in catalytic converters, which is gaining traction as a viable solution to reduce environmental impact. The market for recycled catalytic converters is expected to grow, driven by the rising costs of raw materials and the need for sustainable practices. In 2025, the recycling segment is anticipated to represent a significant portion of the overall vehicle catalytic converter market, reflecting a shift towards more sustainable automotive practices. This trend indicates a potential for innovation and growth within the industry.

Growth of Aftermarket Services

The expansion of aftermarket services for catalytic converters is emerging as a crucial driver for the Automotive Catalyst Market. As vehicles age, the need for replacement and repair of catalytic converters becomes more pronounced. The aftermarket segment is expected to grow substantially, driven by the increasing number of vehicles on the road and the rising awareness of emission control. In 2025, the aftermarket for catalytic converters is projected to account for nearly 30% of the total market share. This growth is attributed to the rising consumer preference for maintaining vehicle performance and compliance with emission regulations. Consequently, aftermarket suppliers are likely to enhance their offerings, providing a wider range of catalytic converter options to meet diverse consumer needs, thereby fostering market expansion.

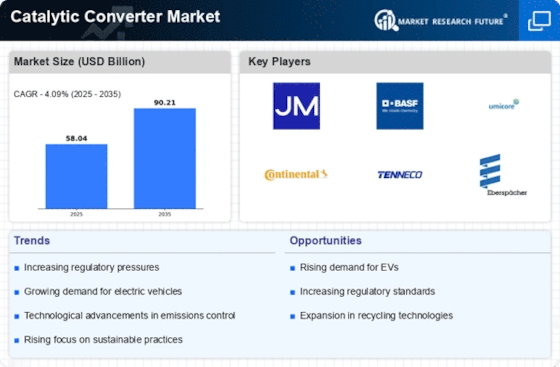

Increasing Emission Regulations

The tightening of emission regulations across various regions appears to be a primary driver for the Catalytic Converter Sector. Governments are implementing stricter standards to combat air pollution and reduce greenhouse gas emissions. For instance, the European Union has set ambitious targets for reducing CO2 emissions from vehicles, which necessitates the use of advanced catalytic converters. This regulatory pressure is likely to propel the demand for high-performance catalytic converters, as manufacturers strive to meet compliance requirements. As a result, the market for catalytic converters is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This trend indicates a robust market environment for catalytic converter manufacturers and suppliers.