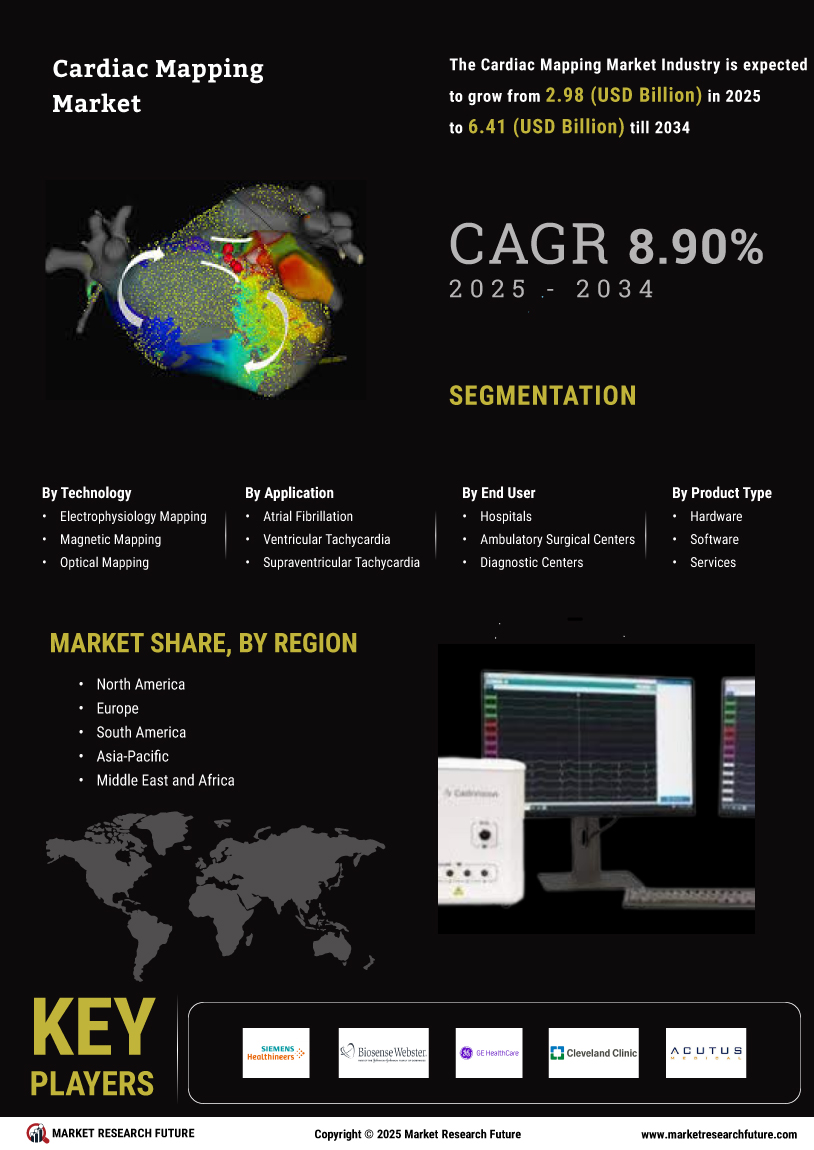

Market Growth Projections

The Global Cardiac Mapping Market Industry is projected to experience substantial growth in the coming years. With an estimated market value of 2.73 USD Billion in 2024, the industry is expected to reach 6.98 USD Billion by 2035. This growth reflects a robust CAGR of 8.91% from 2025 to 2035, driven by various factors including technological advancements, increasing prevalence of cardiac disorders, and rising demand for minimally invasive procedures. The market's expansion is indicative of the growing recognition of the importance of cardiac health and the need for advanced diagnostic tools.

Increasing Prevalence of Cardiac Disorders

The rising incidence of cardiac disorders globally is a primary driver for the Global Cardiac Mapping Market Industry. Factors such as sedentary lifestyles, unhealthy diets, and increased stress levels contribute to the growing number of patients suffering from conditions like atrial fibrillation and heart failure. According to health statistics, the prevalence of these disorders is projected to rise, necessitating advanced diagnostic tools. This trend is expected to propel the market towards a valuation of 6.98 USD Billion by 2035. As healthcare systems prioritize early detection and intervention, the demand for cardiac mapping technologies is likely to surge.

Supportive Government Initiatives and Funding

Government initiatives aimed at improving cardiac care are playing a crucial role in the expansion of the Global Cardiac Mapping Market Industry. Various countries are implementing policies that promote research and development in cardiac technologies. For example, funding for innovative healthcare solutions is increasing, allowing for the development of advanced cardiac mapping systems. These initiatives not only enhance the quality of care but also stimulate market growth. As governments recognize the importance of addressing cardiac health, the financial support for mapping technologies is likely to bolster the industry, contributing to its overall expansion.

Technological Advancements in Mapping Systems

The Global Cardiac Mapping Market Industry is experiencing rapid growth due to ongoing technological advancements in mapping systems. Innovations such as high-resolution imaging and real-time data analytics enhance the accuracy of cardiac procedures. For instance, the integration of 3D mapping systems allows for precise localization of arrhythmias, improving patient outcomes. As these technologies evolve, they are expected to drive market growth, contributing to an estimated market value of 2.73 USD Billion in 2024. The continuous development of sophisticated mapping tools is likely to attract healthcare providers, thereby expanding the Global Cardiac Mapping Market.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive procedures is significantly influencing the Global Cardiac Mapping Market Industry. Patients and healthcare providers increasingly prefer techniques that reduce recovery time and minimize surgical risks. Cardiac mapping technologies facilitate these procedures by providing accurate data for catheter ablation and other interventions. The market is poised for growth as more hospitals adopt these technologies, with a projected CAGR of 8.91% from 2025 to 2035. This trend reflects a broader movement in healthcare towards patient-centric approaches, further driving the demand for advanced cardiac mapping solutions.

Rising Awareness and Education on Cardiac Health

The Global Cardiac Mapping Market Industry is benefiting from increasing awareness and education regarding cardiac health. Public health campaigns and educational programs are informing individuals about the risks associated with cardiac diseases and the importance of early diagnosis. This heightened awareness is leading to more patients seeking diagnostic services, including cardiac mapping. As individuals become more proactive about their health, the demand for advanced mapping technologies is expected to rise. This trend is likely to support the market's growth trajectory, aligning with the overall increase in healthcare expenditure on cardiac care.