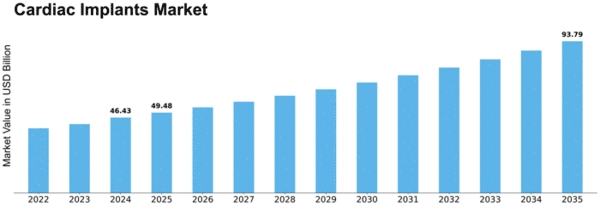

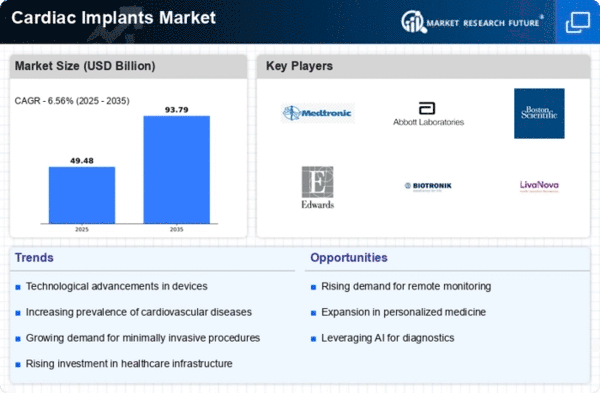

Cardiac Implants Size

Cardiac Implants Market Growth Projections and Opportunities

The Compression therapy marketplace is drastically inspired by the prevalence of vascular problems along with venous insufficiency and deep vein thrombosis. As those conditions affect a big population globally, the demand for Compression therapy products, which aid in improving blood circulation and reducing swelling, continues to develop. The demographic shift towards a growing older populace contributes to the enlargement of the Compression therapy marketplace. Elderly individuals are more prone to vascular problems, and the need for effective compression garments and gadgets to manipulate age-associated circulatory challenges fuels the increase in the marketplace. Ongoing improvements in the compression era play a critical role in shaping the market. Innovations in materials, garment design, and compression gadgets make contributions to advanced consolation, efficacy, and affected person compliance, riding marketplace tendencies. The sports activities and fitness industry contributes to the growth of the Compression therapy marketplace. Athletes use compression clothes to decorate performance, lessen muscle fatigue, and accelerate healing. Compression therapy plays a vital function in submit-surgery rehabilitation, in particular after orthopedic or vascular surgeries. The use of compression clothes helps decrease swelling, promotes healing, and helps the recovery system, influencing the market for postoperative care. Individuals with diabetes are at an extended danger of developing vascular headaches. Compression therapy is utilized in diabetic control to address flow issues and save conditions like diabetic neuropathy, contributing to the marketplace's growth in diabetic care. Patient comfort and compliance are vital factors influencing the adoption of Compression therapy. Manufacturers' attention on growing products that are snug to wear for extended durations, encouraging patient adherence to remedy plans and undoubtedly impacting marketplace demand. The development of healthcare infrastructure, especially in rising markets, impacts the accessibility of Compression therapy products. Improved get right of entry to healthcare centers, and cognizance campaigns contribute to multiplied adoption, particularly in areas in which vascular disorders are customary. The availability of coverage coverage and favorable reimbursement rules for Compression therapy products impact marketplace dynamics. Healthcare guidelines that support the compensation of compression clothes and devices make these remedies more reachable to a broader populace. The upward thrust of e-trade platforms enables direct-to-purchaser sales of Compression therapy products. Consumers can, without difficulty, access quite a few compression clothes online, influencing marketplace accessibility and increasing the reach of these healing answers.

Leave a Comment