Carbon Fiber Size

Market Size Snapshot

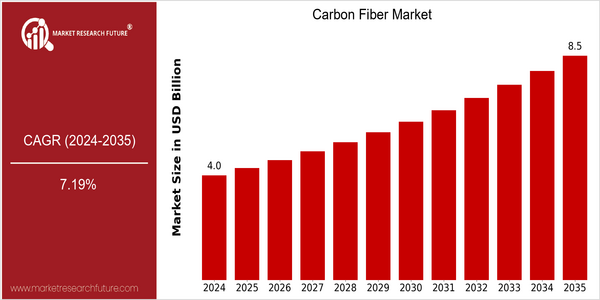

| Year | Value |

|---|---|

| 2024 | USD 3.96 Billion |

| 2035 | USD 8.5 Billion |

| CAGR (2025-2035) | 7.19 % |

Note – Market size depicts the revenue generated over the financial year

Carbon fibre is a very promising material for the future. The carbon fibre market is estimated to be worth $ 3.96 billion in 2024 and is expected to reach $ 8.49 billion by 2035. It will grow at a very healthy CAGR of 7.19 per cent from 2025 to 2035. The rising demand for lightweight and high-strength materials in various industries, especially in the aero-space, automobile and sporting goods sectors, will be a major growth driver. Technological advancements in carbon fibre manufacturing processes, such as the development of cost-effective manufacturing methods and methods of carbon fibres, will further increase the potential of the market and make it more accessible. The main players in the market, such as Toray Industries, Hexcel and Mitsubishi Chem-cial Holdings, are constantly launching new products to take advantage of the market growth. These companies are investing in research and development to improve the properties of carbon fibres. The formation of new collaborations and joint ventures to expand their production capabilities and enter new markets is also becoming increasingly common. And as the industry evolves, the integration of carbon fibres in new applications, such as electric vehicles and wind energy, will continue to drive the market growth.

Regional Market Size

Regional Deep Dive

The Carbon Fibre Market is experiencing significant growth in the regions, driven by the growing demand from the aeronautical, automobile, and sporting goods industries. North America leads in terms of innovation and production, while Europe is more focused on sustainable development and compliance with regulations. Asia-Pacific is experiencing strong growth as a result of its industrialization and its need for public works. The Middle East and Africa are undergoing a significant upturn, especially in the oil and gas sector, while Latin America is gradually adopting carbon fibre technology, which is being influenced by the local initiatives of manufacturers.

Europe

- The European Union's Green Deal is pushing for the adoption of sustainable materials, leading to increased investments in carbon fiber recycling technologies.

- Companies like SGL Carbon and BASF are collaborating on innovative projects to develop bio-based carbon fibers, aligning with the region's sustainability goals.

Asia Pacific

- China is rapidly increasing its carbon fiber production capacity, with state-backed initiatives aimed at reducing dependency on foreign materials and enhancing domestic manufacturing.

- Japan's Toray Industries is pioneering advancements in carbon fiber composites for the aerospace sector, significantly impacting the region's market dynamics.

Latin America

- Brazil is seeing a rise in carbon fiber applications in the automotive sector, driven by local manufacturers seeking to enhance vehicle performance and fuel efficiency.

- Government initiatives aimed at boosting local manufacturing capabilities are encouraging investments in carbon fiber technologies across the region.

North America

- The U.S. is home to major players like Hexcel Corporation and Toray Industries, which are investing heavily in R&D to enhance carbon fiber production processes and reduce costs.

- Recent regulatory changes aimed at promoting lightweight materials in the automotive sector are driving demand for carbon fiber, particularly in electric vehicle manufacturing.

Middle East And Africa

- The UAE is investing in carbon fiber technologies for its aerospace and defense sectors, with companies like Strata Manufacturing leading the way in local production.

- Regulatory support for lightweight materials in the oil and gas industry is creating new opportunities for carbon fiber applications in the region.

Did You Know?

“Carbon fiber is five times stronger than steel while being significantly lighter, making it an ideal material for high-performance applications.” — American Composites Manufacturers Association

Segmental Market Size

The aeronautical section of the carbon fibre market plays a key role in improving the performance and efficiency of aircraft and is currently experiencing strong growth. In particular, the increasing demand for light materials, which reduce fuel consumption and CO2 emissions, and the growing emphasis on the environment and on the protection of the environment, are driving this market. The development of carbon fibre production processes is also contributing to this growth, as it is enabling high-performance composites to be manufactured at lower cost. The aeronautical industry has reached the stage where it is already deploying carbon fibre on a large scale, with companies such as Airbus and Boeing taking the lead in integrating carbon fibre composites into their aircraft designs. Notable applications include the wings, fuselage and interior components. The increasing trend towards greener aviation and the increasing importance of reducing CO2 emissions are accelerating the growth of this market. And advances in automated fibre placement and resin transfer moulding are enabling aeronautical applications to be made even more efficient and cost-effective.

Future Outlook

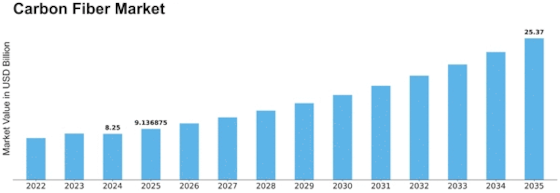

The market for carbon fibres is set to grow at a hefty CAGR from 2024 to 2035. It is underpinned by the increasing demand for lightweight and high-strength materials across several industries, particularly in the aerospace, automotive, and wind energy sectors. Carbon fibres are the perfect alternative to replace heavy metals in these applications. By 2035, it is expected to capture approximately 15 to 20 percent of the composite materials market, driven by the technological advancements and cost reductions that make it more accessible to a wider range of applications. Furthermore, the development of more efficient manufacturing processes and of the recycling of carbon fibres will further propel the market. And the automation of fibre placement and the development of new resin systems will boost the performance and lower the costs of carbon fibres. Furthermore, the government policies promoting sustainable materials and reducing carbon footprints will boost the uptake of carbon fibres. The trend towards the use of carbon fibres in electric vehicles and wind energy blades will also play a significant role in the growth of the market. And with the increasing emphasis on sustainable and high-performance materials across several industries, the carbon fibre market is set to see a meteoric rise.

Leave a Comment