Caraway Seeds Size

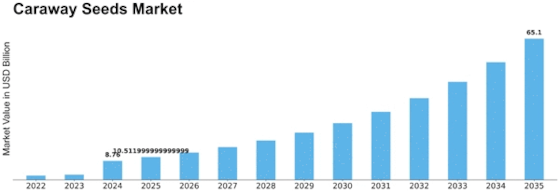

Caraway Seeds Market Growth Projections and Opportunities

The Caraway Seeds market is influenced by several key factors that collectively define its dynamics and growth patterns. One of the primary drivers of this market is the increasing consumer awareness of the health benefits and culinary versatility of caraway seeds. As people become more health-conscious, they are exploring natural ingredients with nutritional value, and caraway seeds, known for their digestive properties and rich flavor, have gained popularity. The perceived health benefits and the ability to enhance the taste of various dishes contribute to the growing demand for caraway seeds in both culinary and wellness applications.

Changing dietary preferences and the global trend towards diverse and exotic cuisines also play a significant role in the Caraway Seeds market. Caraway seeds, with their distinctive warm and slightly sweet flavor, are integral to the cuisines of many cultures, including European, Middle Eastern, and Indian. As consumers embrace a more adventurous approach to food, the demand for ingredients like caraway seeds that add unique and authentic flavors to dishes has increased, driving the growth of the market.

The influence of the wellness and natural remedies sector is evident in the Caraway Seeds market. Caraway seeds have a history of traditional medicinal use for digestive ailments, and this has contributed to their inclusion in various wellness products such as teas, herbal remedies, and dietary supplements. As interest in natural and holistic approaches to health continues to grow, caraway seeds find applications beyond the culinary realm, further expanding their market reach.

Globalization and the ease of international trade are key factors impacting the Caraway Seeds market. With increased accessibility to a variety of ingredients from different regions, consumers have the opportunity to explore and incorporate diverse flavors into their cooking. Caraway seeds, being a globally recognized spice, have benefitted from this trend as they are readily available in markets worldwide, allowing consumers to experiment with new recipes and culinary traditions.

The impact of climate and geography on caraway cultivation is a notable aspect of the market. Caraway seeds thrive in specific climate conditions, and regions with favorable climates for cultivation play a crucial role in the overall supply chain. Variations in climate, soil types, and agricultural practices contribute to the diversity of caraway seeds, influencing their flavor profiles and characteristics. This geographic diversity adds to the market's richness, offering consumers a range of options based on their preferences.

Technological advancements in agriculture and food processing also influence the Caraway Seeds market. Modern farming practices and processing techniques contribute to increased yields, improved quality, and efficient supply chain management. These technological advancements ensure a more consistent and reliable supply of caraway seeds to meet the demands of both the culinary and commercial sectors.

The influence of consumer perceptions of sustainability and ethical sourcing practices is growing in the Caraway Seeds market. Consumers are increasingly concerned about the environmental and social impact of their food choices. This has led to a demand for sustainably sourced caraway seeds, prompting companies to adopt responsible sourcing practices and transparent supply chains to meet consumer expectations and build brand trust.

Cultural and culinary trends shape the demand for caraway seeds in the global market. As consumers seek authentic and traditional flavors, caraway seeds become an essential ingredient in dishes that reflect specific cultural identities. The popularity of ethnic cuisines and the desire for genuine taste experiences contribute to the market's growth as caraway seeds find applications in diverse culinary traditions.

Leave a Comment