Rising Energy Costs

The increasing costs of traditional energy sources in Canada are driving the growth of the photovoltaic market. As fossil fuel prices fluctuate, consumers and businesses are seeking more stable and predictable energy costs. The photovoltaic market offers a viable alternative, allowing users to generate their own electricity and reduce reliance on grid power. In 2025, the average residential electricity price in Canada is projected to rise by approximately 5%, further incentivizing the adoption of solar technologies. This trend suggests that as energy prices continue to escalate, the demand for photovoltaic systems will likely increase, positioning the photovoltaic market as a key player in the energy landscape.

Environmental Awareness

Growing environmental consciousness among Canadians is significantly influencing the photovoltaic market. As climate change concerns escalate, individuals and organizations are increasingly prioritizing sustainable energy solutions. The photovoltaic market aligns with these values, providing a clean and renewable energy source. In 2025, surveys indicate that over 70% of Canadians support the transition to renewable energy, reflecting a societal shift towards sustainability. This heightened awareness is likely to drive investments in solar technologies, as consumers seek to minimize their carbon footprint and contribute to a greener future. Consequently, the photovoltaic market is expected to experience robust growth as more Canadians embrace eco-friendly energy solutions.

Technological Innovations

Advancements in solar technology are playing a crucial role in shaping the photovoltaic market in Canada. Innovations such as improved solar panel efficiency and energy storage solutions are making solar energy more accessible and cost-effective. In 2025, the average efficiency of solar panels is projected to reach 22%, enhancing energy output and reducing payback periods for consumers. Furthermore, the integration of smart technologies allows for better energy management and optimization. These technological developments not only attract new customers but also encourage existing users to upgrade their systems, thereby expanding the photovoltaic market. As technology continues to evolve, the potential for increased adoption and market growth remains substantial.

Government Policy and Regulation

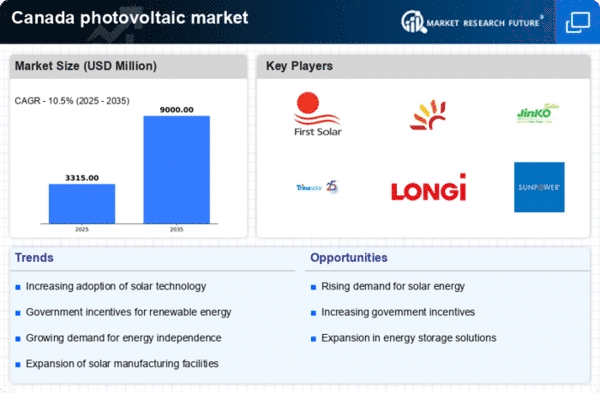

The regulatory framework surrounding renewable energy in Canada is evolving, creating a favorable environment for the photovoltaic market. Government policies aimed at reducing greenhouse gas emissions and promoting clean energy are likely to enhance market conditions. In 2025, various provinces are expected to implement new incentives for solar energy adoption, including tax credits and rebates. These initiatives could lower the initial investment costs for consumers, making photovoltaic systems more appealing. Additionally, streamlined permitting processes and supportive legislation are expected to facilitate market entry for new players. As a result, the photovoltaic market is poised for expansion, driven by proactive government measures.

Rural Electrification Initiatives

Rural electrification efforts in Canada are significantly impacting the photovoltaic market. Many remote and rural areas lack access to reliable electricity, making solar energy an attractive solution. The photovoltaic market provides a decentralized energy source that can be deployed in off-grid locations, enhancing energy access for underserved communities. In 2025, initiatives aimed at improving energy access in rural regions are expected to gain momentum, with government and non-profit organizations collaborating to promote solar installations. This focus on rural electrification not only addresses energy inequality but also stimulates growth in the photovoltaic market, as more households and businesses turn to solar solutions.