Fraud Detection and Prevention

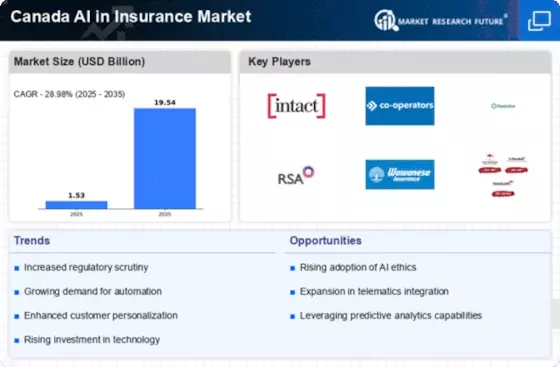

Fraud remains a significant challenge in the Canada Ai In Insurance Market, prompting insurers to adopt AI-driven solutions for detection and prevention. AI algorithms can analyze patterns and anomalies in claims data, identifying potential fraudulent activities with greater accuracy. In 2025, it was estimated that AI technologies reduced fraud-related losses by approximately 25 percent for Canadian insurers. This capability not only protects insurers' bottom lines but also enhances trust among policyholders. As fraud detection becomes increasingly sophisticated, the Canada Ai In Insurance Market is likely to see continued investment in AI technologies.

Automation of Claims Processing

Automation is transforming the claims processing landscape within the Canada Ai In Insurance Market. By employing AI technologies, insurers can streamline claims handling, reducing processing times and enhancing customer satisfaction. Reports indicate that automated claims processing can decrease operational costs by up to 30 percent. As a result, many Canadian insurance firms are investing in AI solutions to improve their claims management systems. This shift not only optimizes resource allocation but also fosters a more efficient claims experience for policyholders, indicating a robust growth trajectory for the Canada Ai In Insurance Market.

Enhanced Data Analytics Capabilities

The Canada Ai In Insurance Market is experiencing a surge in the adoption of advanced data analytics tools. These tools enable insurers to analyze vast amounts of data, leading to improved decision-making processes. For instance, predictive analytics can identify potential risks and customer behaviors, allowing for tailored insurance products. In 2025, it was reported that over 60 percent of Canadian insurers utilized AI-driven analytics to enhance their operational efficiency. This trend is likely to continue, as companies seek to leverage data for competitive advantage, thereby driving growth in the Canada Ai In Insurance Market.

Personalization of Insurance Products

The demand for personalized insurance products is on the rise within the Canada Ai In Insurance Market. Insurers are increasingly utilizing AI to analyze customer data and preferences, allowing them to offer tailored coverage options. This trend is supported by a 2025 survey revealing that 70 percent of Canadian consumers prefer personalized insurance solutions. By leveraging AI, insurers can create customized policies that meet individual needs, thereby enhancing customer loyalty and retention. This focus on personalization is expected to drive innovation and growth in the Canada Ai In Insurance Market.

Regulatory Compliance and Risk Management

Navigating regulatory requirements is a critical aspect of the Canada Ai In Insurance Market. Insurers are leveraging AI to ensure compliance with evolving regulations and to manage risks effectively. AI tools can automate compliance checks and monitor changes in legislation, reducing the burden on human resources. In 2025, it was reported that 55 percent of Canadian insurers utilized AI for regulatory compliance purposes. This proactive approach not only mitigates risks but also enhances operational efficiency, suggesting a promising future for the Canada Ai In Insurance Market as it adapts to regulatory challenges.