Rising Awareness and Education

Increased awareness about bunions and their treatment options is a crucial driver for the Global Bunion (Hallux Valgus) Treatment Market Industry. Educational campaigns by healthcare providers and associations have led to greater public knowledge regarding the condition and its implications. Patients are now more informed about the available treatments, including both conservative and surgical options. This heightened awareness is likely to result in more individuals seeking medical advice and treatment, thereby expanding the market. As awareness continues to grow, it is anticipated that the demand for bunion treatments will further increase, contributing to market expansion.

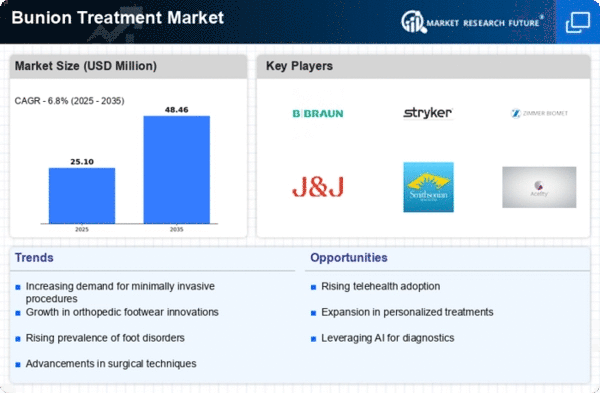

Advancements in Surgical Techniques

Innovations in surgical procedures for bunion correction are significantly influencing the Global Bunion (Hallux Valgus) Treatment Market Industry. Minimally invasive techniques, such as the use of arthroscopy, have improved patient outcomes and reduced recovery times. These advancements not only enhance the effectiveness of treatments but also appeal to patients seeking quicker recovery. As a result, the market is projected to grow from 0.02 USD Billion in 2024 to 0.05 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.34% from 2025 to 2035. This trend indicates a shift towards more efficient and patient-friendly treatment options.

Growing Adoption of Orthotic Devices

The Global Bunion (Hallux Valgus) Treatment Market Industry is also being propelled by the increasing adoption of orthotic devices. These devices, which include custom insoles and bunion splints, provide non-invasive treatment options that alleviate pain and improve foot function. The growing trend towards preventive care and self-management of foot health has led to a rise in the use of these products. As consumers become more health-conscious, the demand for orthotic solutions is expected to grow. This trend is likely to contribute to the overall market growth, as more individuals seek effective, non-surgical alternatives for bunion treatment.

Increasing Prevalence of Bunion Cases

The Global Bunion (Hallux Valgus) Treatment Market Industry is experiencing growth due to the rising prevalence of bunions among various demographics. Factors such as aging populations and lifestyle choices contribute to this increase. For instance, bunions are more common in older adults, with studies indicating that approximately 23% of individuals aged 18-65 and 36% of those over 65 are affected. This growing incidence necessitates effective treatment options, thereby expanding the market. As the population continues to age, the demand for bunion treatments is expected to rise, further driving the market's growth.