Bumper Beam Size

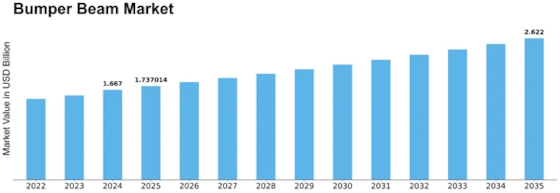

Bumper Beam Market Growth Projections and Opportunities

Numerous market aspects have an impact on the bumper beam market and are essential in determining its dynamics. The general health of the automobile industry is one important element, since bumper beam demand is directly correlated with vehicle production and sales. The need for bumper beams fluctuates with the size of the automobile industry. The demand for bumper beams is influenced by a number of economic factors, including as GDP growth, inflation rates, and consumer spending, which have an effect on people's purchasing power and, in turn, their desire to invest in new cars.

Safety standards and government restrictions are two more important market factors. Authorities throughout the world have enforced strict safety rules, which has prompted automakers to concentrate on integrating cutting-edge safety technologies, such as sturdy bumper beam systems, into their cars. Adherence to these guidelines influences not just the layout and components employed in bumper beams but also the competitive environment as businesses endeavor to fulfill or beyond legal mandates.

Developments in technology have a major impact on how the bumper beam industry has evolved. Advancements in material science, manufacturing procedures, and design methodologies impact the robustness, longevity, and mass of bumper beams. For example, the move toward lightweight materials like composites, aluminum, and high-strength steel resolves concerns about fuel economy and safety. Advancements in technology not only improve bumper beam performance but also have an effect on manufacturing costs and market dynamics.

The car industry's changes and consumer tastes have an additional effect on the bumper beam market. The market for particular types of bumper beams may change in response to shifts in consumer preferences for vehicle types, such as the increasing appeal of SUVs and electric cars. In addition, the growing consciousness of environmental issues has resulted in an increased emphasis on recyclable and sustainable materials for vehicle parts, such as bumper beams.

The environment of the Bumper Beam market is greatly influenced by both local and global economic variables. The cost of raw materials, manufacturing, and distribution can be impacted by variables including trade rules, currency exchange rates, and geopolitical events. These factors can also affect pricing and profit margins for market participants. Variations in these economic factors might provide suppliers and manufacturers in the bumper beam sector with both possibilities and problems.

Leave a Comment