Integration of Telehealth Services

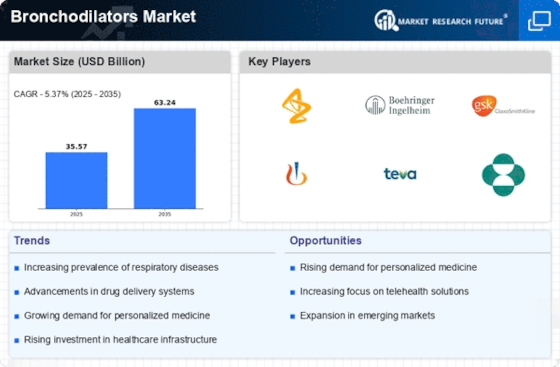

The integration of telehealth services into respiratory care is emerging as a significant driver for the Bronchodilators Market. Telehealth platforms facilitate remote consultations and monitoring, allowing healthcare providers to manage patients with respiratory diseases more effectively. This shift towards digital health solutions has been accelerated by the increasing demand for accessible healthcare services. Patients can receive timely prescriptions for bronchodilators without the need for in-person visits, which may enhance treatment adherence. As telehealth continues to gain traction, it is expected to positively impact the Bronchodilators Market by improving patient access to necessary therapies and fostering better management of respiratory conditions.

Advancements in Pharmaceutical Research

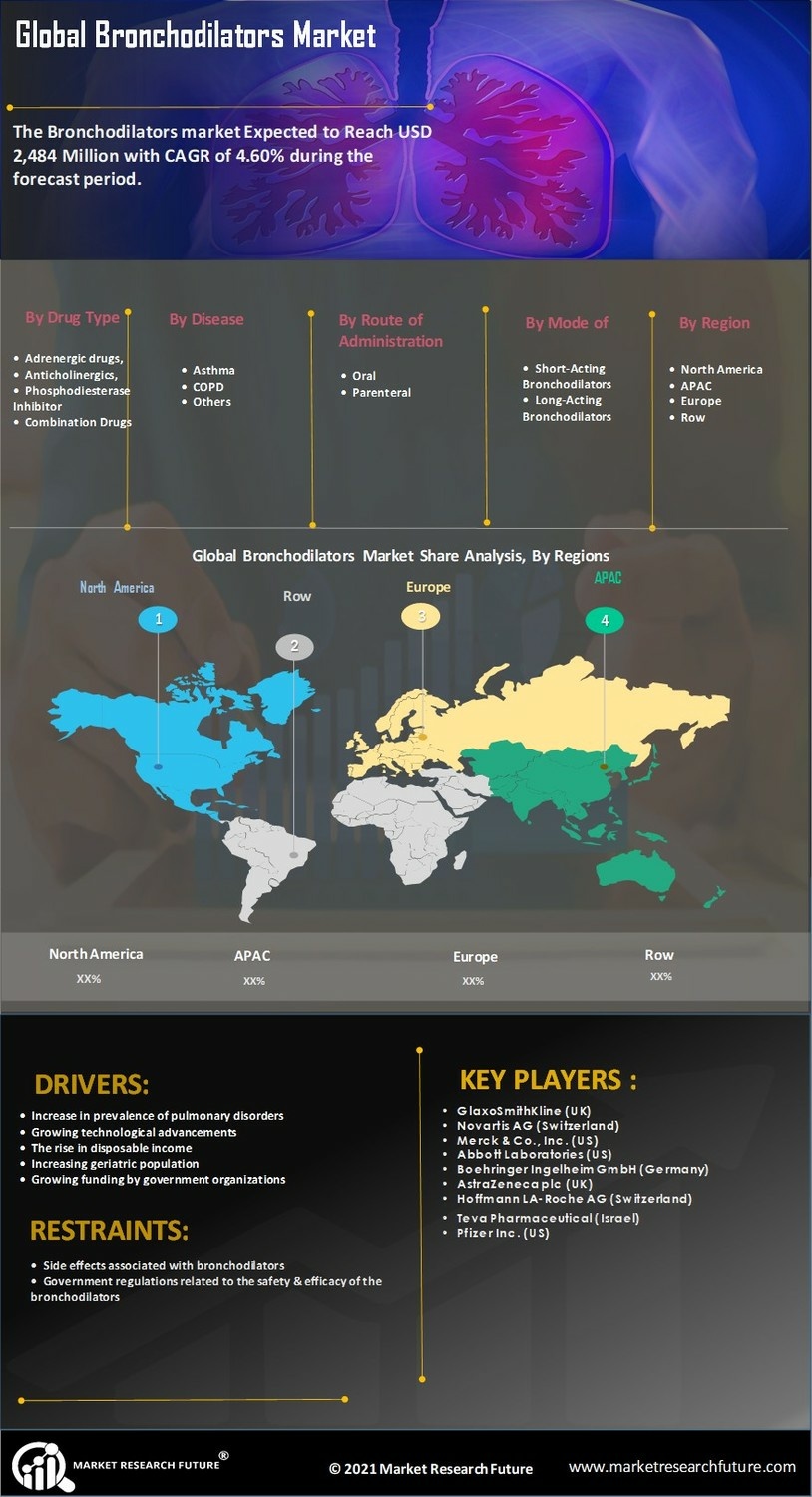

Innovations in pharmaceutical research are playing a crucial role in shaping the Bronchodilators Market. The development of novel bronchodilator formulations, including long-acting beta-agonists and anticholinergics, has enhanced treatment efficacy and patient compliance. Recent studies suggest that the introduction of combination therapies, which integrate multiple active ingredients, may improve overall management of respiratory diseases. Furthermore, the market is witnessing a surge in research focused on personalized medicine, tailoring treatments to individual patient profiles. This evolution in drug development is likely to stimulate market growth, as healthcare providers increasingly adopt advanced therapeutic options to address the diverse needs of patients with respiratory conditions.

Growing Awareness and Education Initiatives

The increasing awareness surrounding respiratory health and the importance of bronchodilator therapy is a significant driver for the Bronchodilators Market. Educational initiatives by healthcare organizations and advocacy groups aim to inform patients about the symptoms and management of respiratory diseases. These efforts are crucial in promoting early diagnosis and treatment adherence, which can lead to improved health outcomes. As patients become more informed about their conditions, the demand for bronchodilators is expected to rise. Additionally, public health campaigns that emphasize the importance of respiratory health are likely to further enhance the visibility of bronchodilator therapies, thereby contributing to market expansion.

Regulatory Support and Approval of New Drugs

Regulatory bodies are increasingly supportive of the development and approval of new bronchodilator therapies, which is a key driver for the Bronchodilators Market. Streamlined approval processes and incentives for innovative drug development have encouraged pharmaceutical companies to invest in research and development. Recent approvals of novel bronchodilator formulations have expanded treatment options available to patients, enhancing the competitive landscape of the market. This regulatory environment not only fosters innovation but also ensures that patients have access to the latest therapeutic advancements. As new products enter the market, the overall growth of the Bronchodilators Market is likely to accelerate.

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD), is a primary driver of the Bronchodilators Market. According to recent estimates, approximately 300 million individuals suffer from asthma worldwide, while COPD affects around 250 million people. This growing patient population necessitates effective treatment options, thereby propelling the demand for bronchodilators. As healthcare systems strive to manage these conditions, the market for bronchodilators is expected to expand significantly. The increasing awareness of respiratory health and the importance of timely intervention further contribute to this trend, indicating a robust growth trajectory for the Bronchodilators Market.