Rising Industrialization

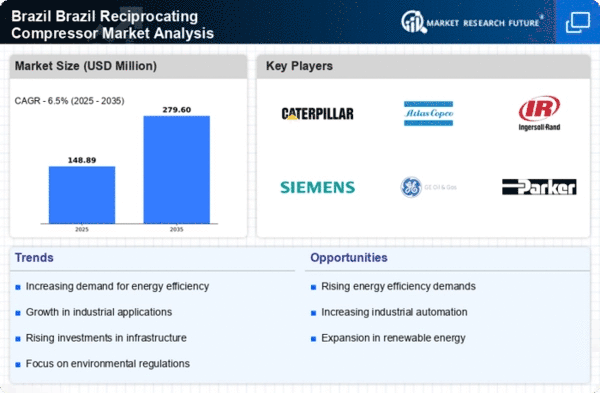

The ongoing industrialization in Brazil appears to be a key driver for the reciprocating compressor market. As industries expand, the demand for efficient and reliable compression solutions increases. The manufacturing sector, particularly in automotive and food processing, is experiencing growth, which necessitates the use of reciprocating compressors for various applications. This trend is supported by government initiatives aimed at boosting industrial output, potentially leading to a market growth rate of around 6% annually. The reciprocating compressor market is likely to benefit from this industrial expansion, as companies seek to enhance productivity and reduce operational costs.

Expansion of Oil and Gas Sector

The oil and gas sector in Brazil is undergoing a transformation, with new discoveries and increased production activities. This expansion is likely to drive the reciprocating compressor market, as these compressors are essential for gas processing and transportation. The sector's growth is supported by Brazil's vast offshore reserves, which are projected to increase production capacity by 1 million barrels per day by 2027. Consequently, the demand for reciprocating compressors in this sector may see a substantial rise, as companies invest in upgrading their facilities to meet production targets.

Growing Focus on Energy Efficiency

There is a noticeable trend towards energy efficiency in Brazil, which is influencing the reciprocating compressor market. Companies are increasingly seeking compressors that not only meet performance standards but also reduce energy consumption. This shift is driven by rising energy costs and regulatory pressures to minimize carbon footprints. The reciprocating compressor market is likely to see innovations aimed at enhancing energy efficiency, potentially leading to a market growth of 5% annually. As businesses prioritize sustainability, the demand for energy-efficient compressors is expected to rise, aligning with broader environmental goals.

Increased Investment in Infrastructure

Brazil's government has been investing heavily in infrastructure projects, which is likely to positively impact the reciprocating compressor market. The construction of new facilities, roads, and energy plants requires reliable compression systems for various applications, including HVAC and refrigeration. With an estimated investment of $100 billion in infrastructure over the next five years, the demand for reciprocating compressors is expected to rise significantly. This influx of capital into infrastructure development may lead to a surge in orders for compressors, as companies look to equip new projects with advanced technology.

Technological Innovations in Compressor Design

Technological advancements in compressor design are playing a crucial role in shaping the reciprocating compressor market. Innovations such as variable speed drives and advanced materials are enhancing the performance and reliability of compressors. These developments are particularly relevant in Brazil, where industries are looking for solutions that can operate efficiently under varying conditions. The introduction of smart technologies, which allow for real-time monitoring and predictive maintenance, is likely to attract more customers. As companies in Brazil adopt these innovations, the reciprocating compressor market may experience a significant uptick in demand, reflecting a shift towards more sophisticated and efficient systems.