Rising Demand for Transparency

The audit software market in Brazil experiences a notable increase in demand for transparency across various sectors. Organizations are increasingly required to provide clear and accessible financial information to stakeholders. This trend is driven by both regulatory requirements and a growing emphasis on corporate governance. In 2025, it is estimated that approximately 70% of companies in Brazil will adopt audit software solutions to enhance their transparency and accountability. This shift not only aids in compliance but also fosters trust among investors and customers. As a result, the audit software market is likely to see substantial growth, with a projected increase in revenue of around 15% annually as businesses prioritize transparency in their operations.

Increased Focus on Cybersecurity

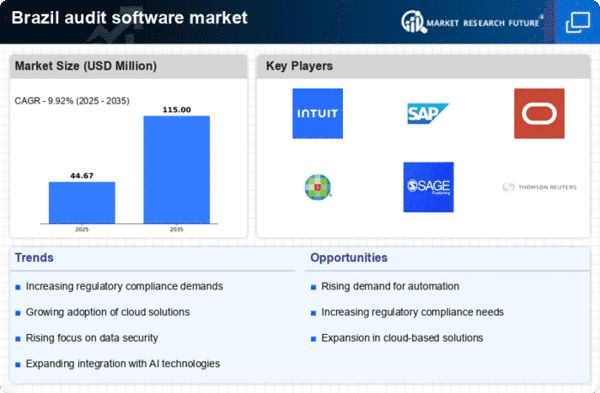

The audit software market in Brazil is witnessing an increased focus on cybersecurity measures. As organizations become more aware of the risks associated with data breaches and cyber threats, the demand for secure audit software solutions is rising. In 2025, it is projected that nearly 65% of companies will prioritize cybersecurity features when selecting audit software. This heightened awareness is likely to drive innovation within the market, as software providers enhance their offerings to include robust security protocols. As a result, the audit software market may experience a growth rate of around 10% as businesses invest in solutions that not only streamline auditing processes but also protect sensitive information.

Shift Towards Remote Auditing Solutions

The audit software market in Brazil is experiencing a shift towards remote auditing solutions, driven by the need for flexibility and efficiency. Organizations are increasingly adopting remote auditing practices to accommodate a more distributed workforce. In 2025, it is expected that around 55% of audit firms will implement remote auditing capabilities within their software. This transition not only allows for greater accessibility but also reduces operational costs associated with traditional auditing methods. As a result, the audit software market may see a growth rate of approximately 11% as firms invest in technologies that support remote auditing and enhance collaboration among audit teams.

Growing Regulatory Compliance Requirements

The audit software market in Brazil is significantly impacted by the growing regulatory compliance requirements imposed by government authorities. As regulations evolve, organizations must adapt their auditing practices to remain compliant. In 2025, it is estimated that compliance-related audits will account for approximately 75% of all audits conducted in Brazil. This trend necessitates the adoption of specialized audit software that can efficiently manage compliance-related tasks. Consequently, the audit software market is likely to expand by about 14% as companies seek solutions that facilitate adherence to regulatory standards and streamline their compliance processes.

Technological Advancements in Data Analytics

Technological advancements in data analytics are significantly influencing the audit software market in Brazil. The integration of advanced analytics tools allows auditors to process vast amounts of data efficiently, leading to more accurate and timely audits. In 2025, it is anticipated that around 60% of audit firms in Brazil will utilize sophisticated data analytics features within their software solutions. This trend not only enhances the quality of audits but also reduces the time required for audit completion. Consequently, the audit software market is expected to grow by approximately 12% as firms seek to leverage these technologies to improve their audit processes and deliver better insights to clients.