Research Methodology on Bladder Cancer Detection Kit Market

Introduction

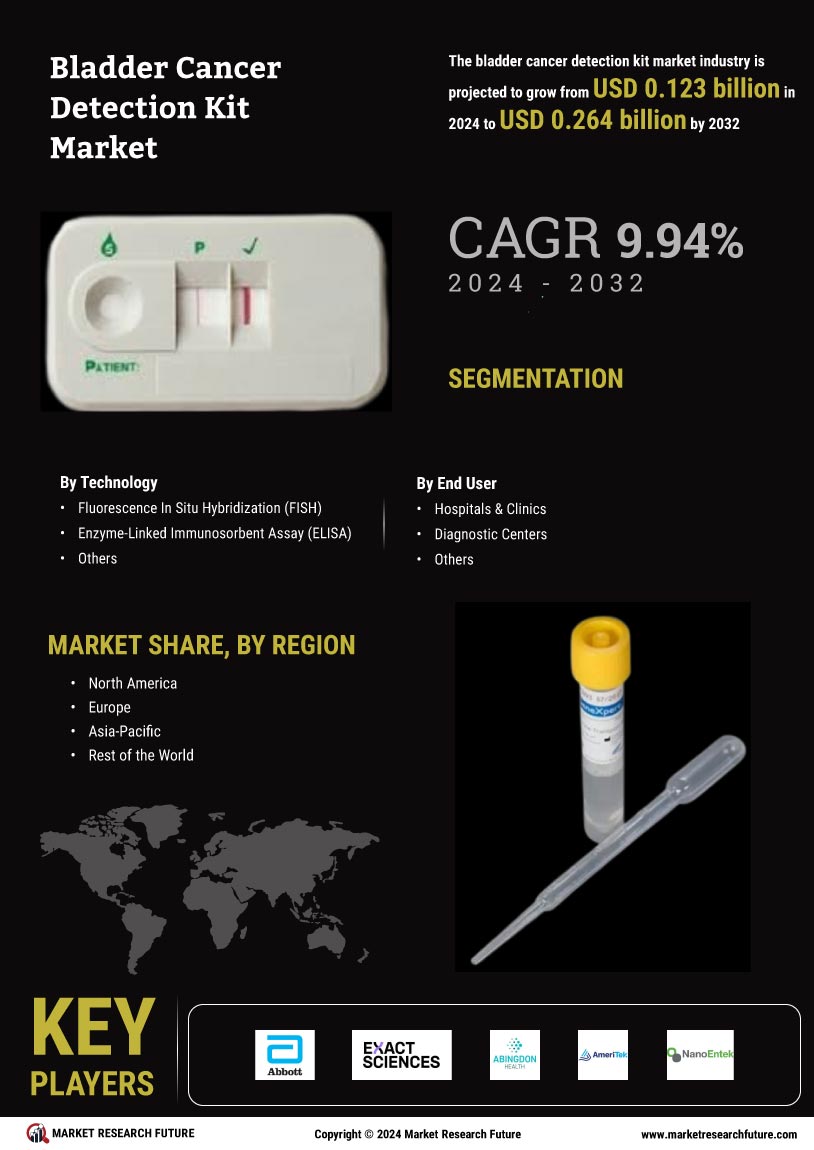

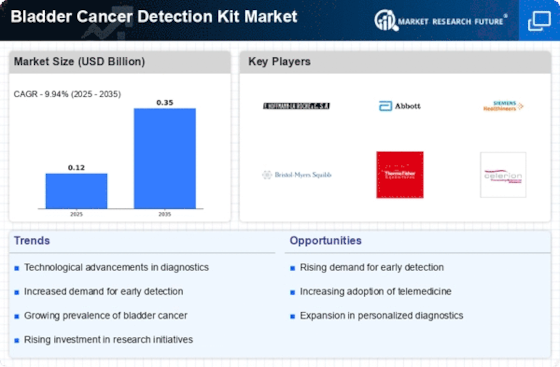

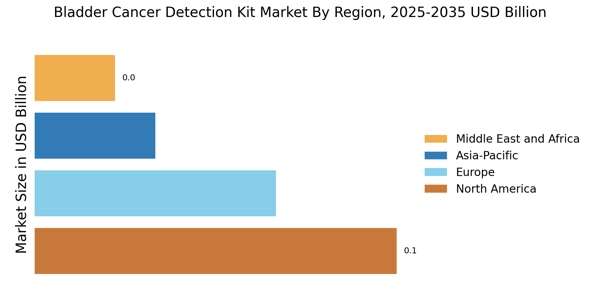

This research report aims to analyze the “Bladder Cancer Detection Kit Market” in the global market context. Although bladder cancer is one of the most common cancers among men, the actual rate of bladder cancer occurrence in the global population is quite low with only about 1% of all cancers being diagnosed as bladder cancer. This report will focus on the factors that are driving the growth of the bladder cancer detection kit market and the factors that will interact with them, along with the market forecast for 2023 to 2030.

Research Design

The research design to be used for this study will be quantitative research with a focus on primary data collection. The researcher will conduct focus group discussions and in-depth interviews with experts and stakeholders involved in the bladder cancer detection kit industry. These focus group discussions and in-depth interviews will be conducted to get a clear picture of the market trends and to analyze the factors that are driving the growth of the bladder cancer detection kit market.

Data Sources

The data sources for this research will include both primary and secondary data sources. The primary data sources will include interviews and focus group discussions with experts and stakeholders in the bladder cancer detection kit industry. The secondary data sources will include published papers, press releases, secondary literature from medical, pharmaceutical and technology journals, industry reports by relevant associations and other publicly available data sources like official websites and government agencies.

Data Collection

The primary data for this research will be collected through in-depth interviews and focus group discussions with stakeholders in the bladder cancer detection kit industry. The interviews and focus group discussions will be conducted to understand market trends, identify opportunities, and analyze the factors that are driving the growth of the bladder cancer detection kit market. The questions that will be asked during the interviews and focus group discussions will include those which are relevant to identify market trends, analysing opportunities in the bladder cancer detection kit market, identifying the target market for the bladder cancer detection kit, and also analyze the competitive landscape in the bladder cancer detection kit industry. The secondary data sources will also be used to supplement the primary data collection process.

Data Analysis

The data collected through the primary and secondary data sources will be analyzed using standard statistical tools like regression analysis and correlation analysis. The data will be analyzed to identify market trends, identify opportunities, and also to analyze the factors that are driving the growth of the bladder cancer detection kit market. The data will also be used to analyze the competitive landscape in the bladder cancer detection kit industry and to determine the potential target markets and the factors that will influence these potential markets.